ValueWalk– This study investigates whether investors see through materially misstated earnings, and whether they anticipate earnings restatements.

Joseph Golec

Report Finds “Conflicts of Interest” Have No Effect on FDA Advisory Committee Votes

Policy and Medicine – Stringent conflicts-of-interest policies keep many experts off of FDA advisory committees. A new study suggests that the fear of pro-industry bias underlying these policies may be misplaced, and also serves to keep highly qualified candidates off of these committees.

James C. Cooper, director of research and policy at the Law and Economics Center at George Mason Law School and Joseph Golec, professor of Finance of the University of Connecticut, who conducted the study, sought to compare conflicted members’ voting patterns with objective criteria. They found that decisions by advisory committees with conflicted members to recommend drugs were more likely to be consistent with both the ultimate FDA decision as well as stock market predictions than non-conflicted advisory committees and members.

2014 Marketing Faculty Awards

- Nicholas Lurie, associate professor of marketing, received the School of Business 2014 Best Paper Award for his Journal of Marketing Research article, “Temporal Contiguity and Negativity Bias in the Impact of Online Word of Mouth,” co-authored with Zoey Chen, University of Miami.

- Bill Ross, Voya Financial Global Chair and professor of marketing, and coauthors Hang Thu Nguyen, Michigan State University, and Joseph Golec, University of Connecticut, received the Best Paper Award in the Branding Track at the 2014 American Marketing Association Winter Educators Conference for their paper titled, Acquisition Value Creation: The Role of Marketing Relationships in Uncertain Environments.

- Girish Punj, professor of marketing, received the School of Business Graduate Teaching Award.

UConn Finance Professors Propose New Method to Estimate the Full Value-Effect of an Event

Storrs, Conn. (5/20/2014) – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Storrs, Conn. (5/20/2014) – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Finance researchers and practitioners both use the event study method to measure whether the announcement of new information has a statistically significant effect on a firm’s stock market value. Paul Borochin and Joseph Golec, professors of finance at the University of Connecticut, recently proposed a method that uses stock and option prices to account for the degree of investor anticipation of an event to therefore more accurately measure the full value effect of that event.

“The purpose of our study is to introduce a general method of estimating the degree of investor anticipation applicable to all significant events that affect firms with traded options,” says Borochin. “We apply this more general method to estimate probabilities to a complex event: U.S. House of Representatives passage of the healthcare reform law, the Patient Protection and Affordable Care Act of 2010 (PPACA). We also examine a related event with different potential for investor anticipation: the subsequent 2012 Supreme Court ruling on PPACA constitutionality, which was potentially a greater surprise due to the Court’s higher opacity.”

Borochin and Golec essentially interpret the financial market as a betting market. “…we get the same information from options prices that we could obtain from looking at the Intrade [or other betting market] website,” says Borochin.

“Indeed, one reason that we select PPACA passage to illustrate our method is that it also had event securities traded on Intrade, the leading prediction market at the time,” he says. “We compare the Intrade-generated probabilities for the 2010 and 2012 events to those we generate from options and stock prices as a robustness check. Our financial market-generated probabilities have two advantages over prediction market-generated probabilities: (1) they are derived from assets with much larger dollar volumes of trades,1 and (2), they can be estimated for any event that impacts companies with traded stock options.”

Borochin and Golec believe that their method could be useful for ex ante as well as ex post public policy analysis, citing legislation that often contains offsetting provisions negotiated among different political factions—in this case, the PPACA fee (tax) on brand name pharmaceutical sales.

They measure the effects ex post, but the method could be used for ex ante analysis by government or industry officials. “For example, Congress could publicly release a bill and a vote date. Based on the option market reaction to the vote announcement, both government and industry officials could determine investors’ estimates of the net effect of the bill’s provisions,” says Borochin.

“Our method could also be used to better estimate public or private damages associated with an event,” he adds. “The Securities and Exchange Commission often estimates damages from corporate fraud and the Federal Trade Commission estimates damages from illegal business practices. As long as some of the firms involved have traded stock and options, our method can give a more accurate estimate of total damages.”

Many event studies do not adjust for the fact that their events are partly anticipated, and in many cases, the degree of anticipation is difficult to measure. For the PPACA House vote event Borochin and Golec consider, the adjustment triples the measured effect of the event on the market value of the affected firms.

“We believe that [our method] is likely to be more precise than alternative methods such as using public data on firm-specific attributes to estimate event probabilities, or using event securities from relatively small prediction markets, because our method employs high-volume assets whose prices may partly reflect nonpublic information. For an event with substantial public information available (House passage), we find our probability estimate and that of a prediction market are quite close. But for an event with little public information (Supreme Court constitutionality), the estimates differ considerably,” said Borochin.

The working paper, “Using Options to Measure the Full Value-Effect of an Event: Application to the Healthcare Reform Act,” can be downloaded here.

1The daily value of PPACA contracts on Intrade averaged about $90,000 around the 2010 House vote event, while the average daily dollar value of stock ($277 million) and notional value of options ($397 million) traded for each company in our model totaled $674 million. The daily Intrade value was $35,000 during the 2012 Supreme Court event, while the average dollar stock and notional options trade value was $640 million.

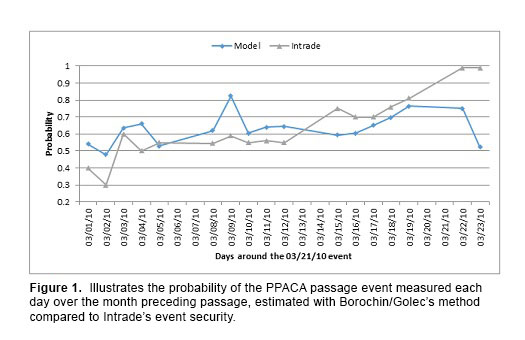

Figure 1 –

The model-generated probability of PPACA passage compared to the Intrade-generated probability.

This figure plots the model-generated probability of PPACA passage by the U.S. House of Representatives, which is the probability implied by the stock and options prices of six hospital firms and six insurance firms. The Intrade-generated probability of PPACA passage is the price of an event security traded on the Intrade prediction market. Probabilities are shown for three weeks of trading before the event, the event day (March 22, 2010), and the day following the event.

UConn Finance Professors Propose New Method to Estimate the Full Value-Effect of an Event

Storrs, Conn. – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Storrs, Conn. – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Finance researchers and practitioners both use the event study method to measure whether the announcement of new information has a statistically significant effect on a firm’s stock market value. Paul Borochin and Joseph Golec, professors of finance at the University of Connecticut, recently proposed a method that uses stock and option prices to account for the degree of investor anticipation of an event to therefore more accurately measure the full value effect of that event.

“The purpose of our study is to introduce a general method of estimating the degree of investor anticipation applicable to all significant events that affect firms with traded options,” says Borochin. “We apply this more general method to estimate probabilities to a complex event: U.S. House of Representatives passage of the healthcare reform law, the Patient Protection and Affordable Care Act of 2010 (PPACA). We also examine a related event with different potential for investor anticipation: the subsequent 2012 Supreme Court ruling on PPACA constitutionality, which was potentially a greater surprise due to the Court’s higher opacity.”

Borochin and Golec essentially interpret the financial market as a betting market. “…we get the same information from options prices that we could obtain from looking at the Intrade [or other betting market] website,” says Borochin.

“Indeed, one reason that we select PPACA passage to illustrate our method is that it also had event securities traded on Intrade, the leading prediction market at the time,” he says. “We compare the Intrade-generated probabilities for the 2010 and 2012 events to those we generate from options and stock prices as a robustness check. Our financial market-generated probabilities have two advantages over prediction market-generated probabilities: (1) they are derived from assets with much larger dollar volumes of trades,1 and (2), they can be estimated for any event that impacts companies with traded stock options.”

Borochin and Golec believe that their method could be useful for ex ante as well as ex post public policy analysis, citing legislation that often contains offsetting provisions negotiated among different political factions—in this case, the PPACA fee (tax) on brand name pharmaceutical sales.

They measure the effects ex post, but the method could be used for ex ante analysis by government or industry officials. “For example, Congress could publicly release a bill and a vote date. Based on the option market reaction to the vote announcement, both government and industry officials could determine investors’ estimates of the net effect of the bill’s provisions,” says Borochin.

“Our method could also be used to better estimate public or private damages associated with an event,” he adds. “The Securities and Exchange Commission often estimates damages from corporate fraud and the Federal Trade Commission estimates damages from illegal business practices. As long as some of the firms involved have traded stock and options, our method can give a more accurate estimate of total damages.”

Many event studies do not adjust for the fact that their events are partly anticipated, and in many cases, the degree of anticipation is difficult to measure. For the PPACA House vote event Borochin and Golec consider, the adjustment triples the measured effect of the event on the market value of the affected firms.

“We believe that [our method] is likely to be more precise than alternative methods such as using public data on firm-specific attributes to estimate event probabilities, or using event securities from relatively small prediction markets, because our method employs high-volume assets whose prices may partly reflect nonpublic information. For an event with substantial public information available (House passage), we find our probability estimate and that of a prediction market are quite close. But for an event with little public information (Supreme Court constitutionality), the estimates differ considerably,” said Borochin.

The working paper, “Using Options to Measure the Full Value-Effect of an Event: Application to the Healthcare Reform Act,” can be downloaded here.

1The daily value of PPACA contracts on Intrade averaged about $90,000 around the 2010 House vote event, while the average daily dollar value of stock ($277 million) and notional value of options ($397 million) traded for each company in our model totaled $674 million. The daily Intrade value was $35,000 during the 2012 Supreme Court event, while the average dollar stock and notional options trade value was $640 million.

Figure 1 –

The model-generated probability of PPACA passage compared to the Intrade-generated probability.

This figure plots the model-generated probability of PPACA passage by the U.S. House of Representatives, which is the probability implied by the stock and options prices of six hospital firms and six insurance firms. The Intrade-generated probability of PPACA passage is the price of an event security traded on the Intrade prediction market. Probabilities are shown for three weeks of trading before the event, the event day (March 22, 2010), and the day following the event.

Honor, Wisdom, Earnestness: Faculty and Students Recognized for Academic Achievements

The best and brightest of UConn School of Business were honored Friday morning, April 25 at the 2014 School of Business Awards & Honors ceremony. Honorees, family and friends gathered in the Dave Ivry Seminar Classroom at the School of Business in Storrs for the annual celebration, where 2014 Student Hall of Fame Fellows were recognized, Ackerman Scholars were awarded, Faculty Awards were presented, and new members were officially inducted to the Beta Gamma Sigma honor society.Continue Reading

Ph.D. Student Teaching Awards 2013

On February 27, business PhD students and coordinators for the five Ph.D. concentrations celebrated student accomplishments during the last year at the sixth annual “Ph.D. Student Night of Appreciation.” School of Business Dean John Elliott was also in attendance, providing the doctoral students with an opportunity to chat with him informally.

At this event, we announced the winners of the school’s 2013 PhD Student Teaching Awards. Each of the five Ph.D. program concentrations gave a teaching award to a qualified student in their concentration. The coordinators of the five concentrations (John Phillips – ACCT, Joseph Golec – FNCE, Qing Cao – MGMT, Bill Ross – MKTG, and Jan Stallaert – OPIM) then decided as a group which of the winners of a teaching award in a concentration would receive this year’s School of Business teaching award. Dean Elliott made the announcement.

The winners of the 2013 teaching awards in each concentration are:

Accounting – Elizabeth Kohl

Finance – Tingyu Zhou

Marketing – Jeff Carlson

Management – Lauren D’Innocenzo

OPIM – Gang Wang

The winner of the 2013 School of Business Ph.D. Teaching Award (program-wide) is:

Management – Lauren D’Innocenzo

Please join us in congratulating these doctoral students for their superb performance in the classroom and as outstanding teacher-scholars.

Ackerman Scholars Announced

The Dean’s Council has reviewed the Ackerman Scholars at the University of Connecticut School of Business and made the following awards:

Appointed for the next two years (2012-13 and 2013-14) are:

- Jose Cruz, OPIM

- Gary Powell, Management

- Greg Reilly, Management

- Ramesh Sankaranarayanan, OPIM

Continuing in their second year are:

- Sulin Ba, OPIM

- Joe Golec, Finance

- John Harding, Finance

- Suresh Nair, OPIM

- Rex Santerre, Finance

- Zeki Simsek, Management

The Ackerman Scholar award recognizes significant and continuing all round academic productivity among the faculty of the School. It is awarded to faculty who are not already supported by Chair or Professorship appointments. The award is supported by the Ackerman Fund, the School and the departments. The purpose of the Ackerman Fund is to “grant a monetary reward to faculty members who have excelled in classroom teaching, curriculum development, research, outreach to business and state agencies.”

Ph.D. Student Teaching Awards

On March 22, the Ph.D. students and coordinators for the five Ph.D. concentrations met at Willington Pizza for a “BUS Ph.D. Student Night of Appreciation,” where we celebrated student accomplishments during the last year.

At this event, we announced the winners of the school’s 2012 Ph.D. student teaching awards. Each of the five Ph.D. program concentrations gave a teaching award to a qualified student in their concentration. The coordinators of the five concentrations (John Phillips – ACCT, Joe Golec – FNCE, Lucy Gilson – MGMT, Bill Ross – MKTG, and Jan Stallaert – OPIM), along with the program director (Gary Powell), then decided as a group which of the winners of a teaching award in a concentration would receive this year’s School of Business teaching award.Continue Reading

Ph.D. Student Night of Appreciation

On March 24, the University of Connecticut School of Business Ph.D. students and coordinators for School’s five Ph.D. concentrations met at Willington Pizza for a “BUS Ph.D. Student Night of Appreciation,” to celebrate student accomplishments during the last year.

The winners of the School’s 2011 Ph.D. student teaching awards were announced at this event. Each of the five Ph.D. program concentrations gave a teaching award to a qualified student in their concentration. The coordinators of the five concentrations (John Phillips – ACCT, Joe Golec – FNCE, Lucy Gilson – MGMT, Bill Ross – MKTG, and Jan Stallaert – OPIM), along with the program director (Gary Powell), then decided as a group which of the winners of a teaching award in a concentration would receive this year’s School of Business teaching award.

The winner of the 2011 School of Business Ph.D. Student Teaching Award is Reilly White.

The winners of the 2011 teaching awards in the concentrations are:

Accounting – Erin Henry

Finance – Reilly White

Marketing – Hang Nguyen

Management – Michael Kukenberger

OPIM – Pantea Alirezazadeh

Pictured (left to right): Erin Henry, Pantea Alirezazadeh, Reilly White, Gary Powell, Hang Nguyen.