Harvard Law School Forum on Corporate Governance and Financial Regulation– In common ownership, the type of the common owner institution matters. Institutional ownership of firms has seen a marked rise in the past few decades, with average institutional ownership share of a firm rising from 20% to 30% in the 1980s to over 65% of the total by the 2010s, with residual retail ownership correspondingly falling from 80% to less than 35% of the firm. (See Borochin, Paul, and Jie Yang (2017). The Effects of Institutional Investor Objectives on Firm Valuation and Governance, Journal of Financial Economics 126.) Over the same period, the fraction of the average firm held by institutions holding blocks of same-industry rivals has risen from 4.5% to 28%. (See He, Jie, J. Huang, 2017, Product Market Competition in a World of Cross Ownership: Evidence from Institutional Blockholdings, The Review of Financial Studies 30.) This not only changes the portfolio properties of the institutional investors, but also has the potential to change the corporate strategies of held firms. Recent studies find opposing effects of common institutional ownership on the competitive behavior of firms:

Paul Borochin

Celebrations

School Honors Faculty Whose Accomplishments Shine Brightly; Professor Golec Awarded ‘Research Excellence’ Honor

Finance professor Joe Golec, a scholar who keeps a running list of at least 100 potential research topics at all times, was awarded the School of Business’ top honor this spring, its Award for Research Excellence.

Meanwhile accounting professors Yanhua “Sunny’’ Yang and Michael Willenborg earned the School of Business’ Best Paper award for a highly regarded research paper about IPO prices. One of the reasons she chose to work at UConn, Yang said, was the value the University places on research distinction. Continue Reading

Do Managers Seek Control and Entrenchment?

The CLS Blue Sky Blog – Do managers seek control of the firm, or the level of ownership consistent with entrenchment? Entrenched managers own shares within a range which is high enough to give them control, but sufficiently low to make other shareholders bear the brunt of their non-value maximizing actions. There is a large literature on how entrenched managers can benefit themselves by extracting wealth from other shareholders, but conclusive evidence that managers seek entrenchment is currently lacking.

UConn Finance Professors Propose New Method to Estimate the Full Value-Effect of an Event

Storrs, Conn. (5/20/2014) – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Storrs, Conn. (5/20/2014) – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Finance researchers and practitioners both use the event study method to measure whether the announcement of new information has a statistically significant effect on a firm’s stock market value. Paul Borochin and Joseph Golec, professors of finance at the University of Connecticut, recently proposed a method that uses stock and option prices to account for the degree of investor anticipation of an event to therefore more accurately measure the full value effect of that event.

“The purpose of our study is to introduce a general method of estimating the degree of investor anticipation applicable to all significant events that affect firms with traded options,” says Borochin. “We apply this more general method to estimate probabilities to a complex event: U.S. House of Representatives passage of the healthcare reform law, the Patient Protection and Affordable Care Act of 2010 (PPACA). We also examine a related event with different potential for investor anticipation: the subsequent 2012 Supreme Court ruling on PPACA constitutionality, which was potentially a greater surprise due to the Court’s higher opacity.”

Borochin and Golec essentially interpret the financial market as a betting market. “…we get the same information from options prices that we could obtain from looking at the Intrade [or other betting market] website,” says Borochin.

“Indeed, one reason that we select PPACA passage to illustrate our method is that it also had event securities traded on Intrade, the leading prediction market at the time,” he says. “We compare the Intrade-generated probabilities for the 2010 and 2012 events to those we generate from options and stock prices as a robustness check. Our financial market-generated probabilities have two advantages over prediction market-generated probabilities: (1) they are derived from assets with much larger dollar volumes of trades,1 and (2), they can be estimated for any event that impacts companies with traded stock options.”

Borochin and Golec believe that their method could be useful for ex ante as well as ex post public policy analysis, citing legislation that often contains offsetting provisions negotiated among different political factions—in this case, the PPACA fee (tax) on brand name pharmaceutical sales.

They measure the effects ex post, but the method could be used for ex ante analysis by government or industry officials. “For example, Congress could publicly release a bill and a vote date. Based on the option market reaction to the vote announcement, both government and industry officials could determine investors’ estimates of the net effect of the bill’s provisions,” says Borochin.

“Our method could also be used to better estimate public or private damages associated with an event,” he adds. “The Securities and Exchange Commission often estimates damages from corporate fraud and the Federal Trade Commission estimates damages from illegal business practices. As long as some of the firms involved have traded stock and options, our method can give a more accurate estimate of total damages.”

Many event studies do not adjust for the fact that their events are partly anticipated, and in many cases, the degree of anticipation is difficult to measure. For the PPACA House vote event Borochin and Golec consider, the adjustment triples the measured effect of the event on the market value of the affected firms.

“We believe that [our method] is likely to be more precise than alternative methods such as using public data on firm-specific attributes to estimate event probabilities, or using event securities from relatively small prediction markets, because our method employs high-volume assets whose prices may partly reflect nonpublic information. For an event with substantial public information available (House passage), we find our probability estimate and that of a prediction market are quite close. But for an event with little public information (Supreme Court constitutionality), the estimates differ considerably,” said Borochin.

The working paper, “Using Options to Measure the Full Value-Effect of an Event: Application to the Healthcare Reform Act,” can be downloaded here.

1The daily value of PPACA contracts on Intrade averaged about $90,000 around the 2010 House vote event, while the average daily dollar value of stock ($277 million) and notional value of options ($397 million) traded for each company in our model totaled $674 million. The daily Intrade value was $35,000 during the 2012 Supreme Court event, while the average dollar stock and notional options trade value was $640 million.

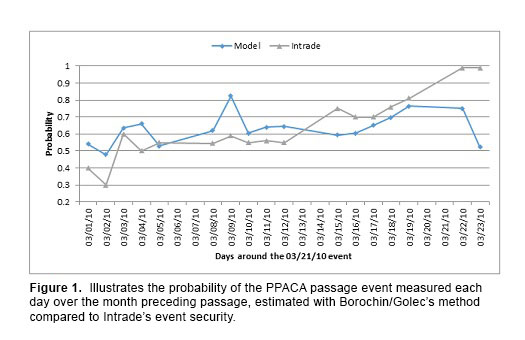

Figure 1 –

The model-generated probability of PPACA passage compared to the Intrade-generated probability.

This figure plots the model-generated probability of PPACA passage by the U.S. House of Representatives, which is the probability implied by the stock and options prices of six hospital firms and six insurance firms. The Intrade-generated probability of PPACA passage is the price of an event security traded on the Intrade prediction market. Probabilities are shown for three weeks of trading before the event, the event day (March 22, 2010), and the day following the event.

UConn Finance Professors Propose New Method to Estimate the Full Value-Effect of an Event

Storrs, Conn. – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Storrs, Conn. – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Finance researchers and practitioners both use the event study method to measure whether the announcement of new information has a statistically significant effect on a firm’s stock market value. Paul Borochin and Joseph Golec, professors of finance at the University of Connecticut, recently proposed a method that uses stock and option prices to account for the degree of investor anticipation of an event to therefore more accurately measure the full value effect of that event.

“The purpose of our study is to introduce a general method of estimating the degree of investor anticipation applicable to all significant events that affect firms with traded options,” says Borochin. “We apply this more general method to estimate probabilities to a complex event: U.S. House of Representatives passage of the healthcare reform law, the Patient Protection and Affordable Care Act of 2010 (PPACA). We also examine a related event with different potential for investor anticipation: the subsequent 2012 Supreme Court ruling on PPACA constitutionality, which was potentially a greater surprise due to the Court’s higher opacity.”

Borochin and Golec essentially interpret the financial market as a betting market. “…we get the same information from options prices that we could obtain from looking at the Intrade [or other betting market] website,” says Borochin.

“Indeed, one reason that we select PPACA passage to illustrate our method is that it also had event securities traded on Intrade, the leading prediction market at the time,” he says. “We compare the Intrade-generated probabilities for the 2010 and 2012 events to those we generate from options and stock prices as a robustness check. Our financial market-generated probabilities have two advantages over prediction market-generated probabilities: (1) they are derived from assets with much larger dollar volumes of trades,1 and (2), they can be estimated for any event that impacts companies with traded stock options.”

Borochin and Golec believe that their method could be useful for ex ante as well as ex post public policy analysis, citing legislation that often contains offsetting provisions negotiated among different political factions—in this case, the PPACA fee (tax) on brand name pharmaceutical sales.

They measure the effects ex post, but the method could be used for ex ante analysis by government or industry officials. “For example, Congress could publicly release a bill and a vote date. Based on the option market reaction to the vote announcement, both government and industry officials could determine investors’ estimates of the net effect of the bill’s provisions,” says Borochin.

“Our method could also be used to better estimate public or private damages associated with an event,” he adds. “The Securities and Exchange Commission often estimates damages from corporate fraud and the Federal Trade Commission estimates damages from illegal business practices. As long as some of the firms involved have traded stock and options, our method can give a more accurate estimate of total damages.”

Many event studies do not adjust for the fact that their events are partly anticipated, and in many cases, the degree of anticipation is difficult to measure. For the PPACA House vote event Borochin and Golec consider, the adjustment triples the measured effect of the event on the market value of the affected firms.

“We believe that [our method] is likely to be more precise than alternative methods such as using public data on firm-specific attributes to estimate event probabilities, or using event securities from relatively small prediction markets, because our method employs high-volume assets whose prices may partly reflect nonpublic information. For an event with substantial public information available (House passage), we find our probability estimate and that of a prediction market are quite close. But for an event with little public information (Supreme Court constitutionality), the estimates differ considerably,” said Borochin.

The working paper, “Using Options to Measure the Full Value-Effect of an Event: Application to the Healthcare Reform Act,” can be downloaded here.

1The daily value of PPACA contracts on Intrade averaged about $90,000 around the 2010 House vote event, while the average daily dollar value of stock ($277 million) and notional value of options ($397 million) traded for each company in our model totaled $674 million. The daily Intrade value was $35,000 during the 2012 Supreme Court event, while the average dollar stock and notional options trade value was $640 million.

Figure 1 –

The model-generated probability of PPACA passage compared to the Intrade-generated probability.

This figure plots the model-generated probability of PPACA passage by the U.S. House of Representatives, which is the probability implied by the stock and options prices of six hospital firms and six insurance firms. The Intrade-generated probability of PPACA passage is the price of an event security traded on the Intrade prediction market. Probabilities are shown for three weeks of trading before the event, the event day (March 22, 2010), and the day following the event.

UConn’s CIBER Case Challenge Proposes Solutions to Real-World International Business Issue

From October 9-12, the UConn School of Business hosted students from universities across the globe to participate in a case competition to solve a real-world challenge.

Now in its third year hosting the CIBER Case Challenge competition, the UConn School of Business Center for International Business Education and Research (CIBER) has taken charge in its mission to increase the competitiveness of U.S. business in the global marketplace, as set forth by the U.S. Department of Education. This year’s competition brought together students hailing from 12 different colleges and universities located within the U.S. as well as higher education institutions as far away as Tokyo, Japan.

Kelly Aceto, managing director of the CIBER Case Challenge, led the event, proposing a challenging problem derived from the global business marketplace for which teams of students were required to envision a solution. The problem was kept secret until its official announcement at 9 a.m. on Friday, October 11, at which point the case was distributed. This year’s challenge? To determine if Gillette should bring its Guard razor into the U.S. market. “I have participated in several case competitions, and this one was very different not only because of the international nature of the problem, but also because everyone on our team had a different area of study, whether it was marketing, accounting, operations, or finance,” says Ningwei Li, a finance and economics major at the University of Maryland, College Park, who came in among the top three finalists for “Best Presenter” in the preliminary round. Each team was comprised of four students from four different universities, each studying a different business discipline.

Unlike traditional case competitions, the CIBER Case Challenge tasked students to demonstrate their ability to work in teams consisting of students from varying cultures and nations. Students first met their teammates virtually two weeks before arriving on the Storrs, Connecticut campus. To facilitate greater bonding within teams prior to the case distribution, students traveled to Mystic, Connecticut to participate in a series of team challenges set against the backdrop of Connecticut’s historical seaport. “My team had students from Italy, California, Arizona, and Rhode Island. I’ve never traveled out of the country, so this experience enabled me to make a lot of connections I wouldn’t have made otherwise,” says Joseph Bona, a management major at Bryant University.

On the third day of the event, students presented their case solutions to a panel of judges composed of international business executives from the local tri-state area business community. Presentations were evaluated based on content (60%) and presentation (40%), considering whether the students did their research, logically supported their conclusions, and whether those conclusions would realistically be accepted by management. “They [the presentations] exceeded my expectations,” says Phil Ferrari, CFO at Virginia Industries, Inc., one of the event judges. “The students were intelligent, cohesive, and desirous to do an outstanding job. Quite impressive.”

The evaluations of the judges held serious weight for the student competitors; only three teams advanced to the final round later that day. “It was hard work to differentiate between the groups as they were excellent,” adds Ferrari. “Groups like this will bode well for the future of business in the U.S.”

The finalists were announced at an awards dinner on Saturday evening, where they were presented with plaques acknowledging their accomplishment:

First Place

GianMarco Taverna, University of North Carolina

Ellie Lin, Purdue University

Margaret Wong, Bryant University

Ihinosen Dibua, Pittsburg University

Second Place

Dallin Shaner, Brigham Young University

Nicole Green, University of Connecticut

Sergio Alessandro Castagnetti, University of Trento

Ben Hsieh, University of Maryland

Third Place

Daisuke Honjo, Rikkyo University

Leah Gonzalez, University of North Carolina

Esther Buck, Belmont University

Josh Emmett, University of Connecticut

Best Presenter

Dallin Shaner, Brigham Young University

Best Q&A

Leah Gonzalez, University of North Carolina

“This experience has been amazing,” says Li. “Despite our differences, most, if not all, of the students are like-minded with how we approach school, career, and our aspirations – with an ambitious, positive attitude. That’s how we connected.” he says.

This year marks the first time that two UConn students have placed among the top three teams in the CIBER Case Challenge. “They were well prepared,” says Aceto. “Paul Borochin, assistant professor of finance at the School of Business, spent a lot of time with the students as they got ready to face the challenges of a case competition.”

In an ever-changing international business climate, the United States has public universities like the University of Connecticut to depend on to challenge their own students to work with students of different backgrounds and nationalities. UConn is one of 33 universities nationwide designated as national resource centers for international business, with UConn CIBER in existence since 1995.

For more information:

About CIBER

CIBER Case Challenge

Pictured: One of the student teams, awarded first place for teamwork during their excursion to Mystic, poses in the School of Business atrium: Raaheela Ahmed, finance and economics major at the University of Maryland; Mike Masso, finance major at the UConn School of Business; Mac Bellingrath, marketing major at Belmont University, and Johanna Kuehl, an accounting major at Manchester Business School.