Check out our Winter 2014 Accounting Department Newsletter!

Storrs

U.S. Joint Chiefs of Staff Chairman Gen. Martin Dempsey to Headline Auriemma UConn Leadership Conf.

Storrs, Conn. – The nation’s highest-ranking military officer will deliver the keynote address at this year’s Geno Auriemma UConn Leadership Conference, Oct. 22 to 23 at the Mohegan Sun Convention Center in Uncasville, Connecticut.

Storrs, Conn. – The nation’s highest-ranking military officer will deliver the keynote address at this year’s Geno Auriemma UConn Leadership Conference, Oct. 22 to 23 at the Mohegan Sun Convention Center in Uncasville, Connecticut.

U.S. Joint Chiefs of Staff Chairman General Martin Dempsey is scheduled to address conference attendees on the first day of the event. Coming on the heels of Geno Auriemma‘s 9th NCAA National Basketball Championship, this conference will focus on Leading for Innovation and Change.Continue Reading

UConn Finance Professors Propose New Method to Estimate the Full Value-Effect of an Event

Storrs, Conn. – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Storrs, Conn. – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Finance researchers and practitioners both use the event study method to measure whether the announcement of new information has a statistically significant effect on a firm’s stock market value. Paul Borochin and Joseph Golec, professors of finance at the University of Connecticut, recently proposed a method that uses stock and option prices to account for the degree of investor anticipation of an event to therefore more accurately measure the full value effect of that event.

“The purpose of our study is to introduce a general method of estimating the degree of investor anticipation applicable to all significant events that affect firms with traded options,” says Borochin. “We apply this more general method to estimate probabilities to a complex event: U.S. House of Representatives passage of the healthcare reform law, the Patient Protection and Affordable Care Act of 2010 (PPACA). We also examine a related event with different potential for investor anticipation: the subsequent 2012 Supreme Court ruling on PPACA constitutionality, which was potentially a greater surprise due to the Court’s higher opacity.”

Borochin and Golec essentially interpret the financial market as a betting market. “…we get the same information from options prices that we could obtain from looking at the Intrade [or other betting market] website,” says Borochin.

“Indeed, one reason that we select PPACA passage to illustrate our method is that it also had event securities traded on Intrade, the leading prediction market at the time,” he says. “We compare the Intrade-generated probabilities for the 2010 and 2012 events to those we generate from options and stock prices as a robustness check. Our financial market-generated probabilities have two advantages over prediction market-generated probabilities: (1) they are derived from assets with much larger dollar volumes of trades,1 and (2), they can be estimated for any event that impacts companies with traded stock options.”

Borochin and Golec believe that their method could be useful for ex ante as well as ex post public policy analysis, citing legislation that often contains offsetting provisions negotiated among different political factions—in this case, the PPACA fee (tax) on brand name pharmaceutical sales.

They measure the effects ex post, but the method could be used for ex ante analysis by government or industry officials. “For example, Congress could publicly release a bill and a vote date. Based on the option market reaction to the vote announcement, both government and industry officials could determine investors’ estimates of the net effect of the bill’s provisions,” says Borochin.

“Our method could also be used to better estimate public or private damages associated with an event,” he adds. “The Securities and Exchange Commission often estimates damages from corporate fraud and the Federal Trade Commission estimates damages from illegal business practices. As long as some of the firms involved have traded stock and options, our method can give a more accurate estimate of total damages.”

Many event studies do not adjust for the fact that their events are partly anticipated, and in many cases, the degree of anticipation is difficult to measure. For the PPACA House vote event Borochin and Golec consider, the adjustment triples the measured effect of the event on the market value of the affected firms.

“We believe that [our method] is likely to be more precise than alternative methods such as using public data on firm-specific attributes to estimate event probabilities, or using event securities from relatively small prediction markets, because our method employs high-volume assets whose prices may partly reflect nonpublic information. For an event with substantial public information available (House passage), we find our probability estimate and that of a prediction market are quite close. But for an event with little public information (Supreme Court constitutionality), the estimates differ considerably,” said Borochin.

The working paper, “Using Options to Measure the Full Value-Effect of an Event: Application to the Healthcare Reform Act,” can be downloaded here.

1The daily value of PPACA contracts on Intrade averaged about $90,000 around the 2010 House vote event, while the average daily dollar value of stock ($277 million) and notional value of options ($397 million) traded for each company in our model totaled $674 million. The daily Intrade value was $35,000 during the 2012 Supreme Court event, while the average dollar stock and notional options trade value was $640 million.

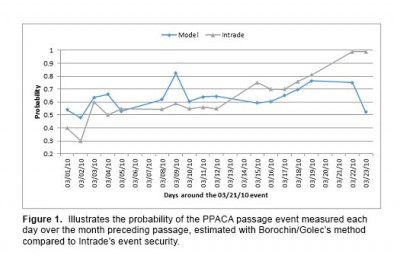

Figure 1 –

The model-generated probability of PPACA passage compared to the Intrade-generated probability.

This figure plots the model-generated probability of PPACA passage by the U.S. House of Representatives, which is the probability implied by the stock and options prices of six hospital firms and six insurance firms. The Intrade-generated probability of PPACA passage is the price of an event security traded on the Intrade prediction market. Probabilities are shown for three weeks of trading before the event, the event day (March 22, 2010), and the day following the event.

Employees Recognized for Years of Service

Dean John Elliott and Associate Deans Sulin Ba, Larry Gramling, and George Plesko recognized employees for their years of service to the University and the State of Connecticut on Friday, May 2, 2014. The Employee Recognition Reception was held in the School of Business Board Room.

The employees recognized were: Continue Reading

12th Annual Real Estate Center Awards Banquet

The 12th Annual Real Estate Awards Banquet was held at the South Campus Ballroom on Thursday, May 1. The special occasion recognized outstanding students, alumni, and scholarship recipients.

The following alumni and students were recognized for their achievements:

- Lifetime Achievement Award: Daniel Ferraina, Ferraina Companies

- Distinguished Alumni: Michael Riccio, CB-Richard Ellis Capital Markets

- Alumni of the Year: Bradford Wainman, Simon Konover Development Corp.

- Early Career Alumni: Kelsey Rath, Talcott Realty Investors, LLC

- Organizational Partner: Greater New Haven Association of Realtors

- Excellence in Research: Professor Carmelo Giaccotto and Professor Thomas Miceli

- Students of the Year: Frances (Frankie) Gibbons and Andrew Kelly

Other student award recipients included: Nicolas Chapman, Tyler Cormier, Julia Dumaine, Andrew Harney, Scott Howard, M. Connor Lyman, Matthew McCandless, Cole McQuilken, Johncarlo Morales, Benjamin Napoli, Bridget O’Malley, Laura O’Malley, Ryan Powers, Peter Rodriguez, Colby Schaefer, Austin Smyth, Melissa Touger, Kristine Victor, and Hui Zhang.

Honor, Wisdom, Earnestness: Faculty and Students Recognized for Academic Achievements

The best and brightest of UConn School of Business were honored Friday morning, April 25 at the 2014 School of Business Awards & Honors ceremony. Honorees, family and friends gathered in the Dave Ivry Seminar Classroom at the School of Business in Storrs for the annual celebration, where 2014 Student Hall of Fame Fellows were recognized, Ackerman Scholars were awarded, Faculty Awards were presented, and new members were officially inducted to the Beta Gamma Sigma honor society.Continue Reading

2nd Session added to Pitch Competition!!

Monday night was a great time at the CCEI Startup Challenge Pitch Competition – in fact, we ran out of time before everyone had their turn to pitch! So, we have scheduled a second session to allow everyone who showed up last night the opportunity to pitch their idea, but also if you were unable to attend on Monday, this will provide you one last opportunity to participate in this fun event. We hope to see you there!

4/9/14, 6:00pm

UConn Storrs Campus

GENTRY 131 (School of Education Building – DIFFERENT LOCATION)

**Pizza, refreshments, and soda provided**

The CCEI Startup Challenge Pitch Competition is the first of two events that comprise the CCEI Startup Challenge initiative. At the Pitch Competition,$10,000 in prize money (ten $1000 prizes) will be awarded to individuals or teams across multiple categories. Individuals or teams can pitch more than one idea, and you could win in more than one category. This competition is open to all UConn Students (all majors, levels, campuses), and the idea can be for anything – we encourage you to get creative! Five of the prize categories are listed below; the other five will be revealed at the event. Pitches will be limited to 90 seconds and will be followed by up to two minutes of Q&A. Have an idea? Pitch it!

First Five Prize Categories Revealed:

- Best Pitch Presentation

- Best Product/Invention Idea

- Best Mobile App Idea

- Most Socially Responsible Idea

- Best College Targeted Idea (“Most Likely to Succeed at UConn”)

1st Annual Risk Management Academic Conference

The Master of Science in Financial Risk Management (MSFRM) Program at the University of Connecticut will host the First Annual Academic Conference on Risk Management at Storrs, Connecticut on May 30, 2014.

Date & Time

- May 30, 2014 (Friday)

- 9am-5pm

Program Committee

- Chinmoy Ghosh

- Chanatip Kitwiwattanachai

- Efdal Misirli

Purpose

The purpose of this conference is to bring together academic researchers at the frontier of risk management and investments. This year’s conference program includes empirical perspectives on credit contagion, hedge fund investment, fire sales, market efficiency, mutual fund investment and media visibility in financial markets, central bank borrowing and risk shifting by banks in Europe.

Invitation

The Finance Department at the UCONN School of Business organizes this conference for the first time this year, and we would like to make it an annual event where prominent scholars and active young researchers present their work and receive valuable feedback. We will be happy if you can join our conference in its inaugural run.

Presenters

1. Jean Helwege, J. Henry Fellers Professor of Business Administration at the University of South Carolina, “Do Hedge Fund Fire Sales Disrupt the Stock Market?” (9:00 – 9:50 am)

Discussant: Namho Kang (University of Connecticut) (9:50 – 10:05 am)

Audience Q&A. (10:05 – 10:15 am)

2. Jennie Bai, Assistant Professor of Finance at Georgetown University, “Non-committable Channel for Credit Contagion”. (10:15 – 11:05 am)

Discussant: Chanatip Kitwiwattanachai (University of Connecticut). (11:05 – 11:20 am)

Audience Q&A. (11:20 – 11:30 am)

Lunch & Remarks from Dean John Elliot (11:30 am – 1:00 pm)

3. Ron Kaniel, Professor of Finance, University of Rochester, “Making the list – the impact of WSJ fund rankings on consumer investment decisions”, (1:00 – 1:50 pm)

Discussant: Jonathan Reuter (Boston College, NBER). (1:50 – 2:05 pm)

Audience Q&A. (2:05 – 2:15 pm)

4. Bing Liang, Professor of Finance, University of Massachusetts Amherst, “Hedge Fund Ownership and Stock Market Efficiency” (2:15 – 3:05 pm)

Discussant: Jean Helwege (University of South Carolina). (3:05 – 3:20 pm)

Audience Q&A. (3:20 – 3:30 pm)

Coffee Break (3:30 – 3:45 pm)

5. Phillip Schnabl, Assistant Professor of Finance, Leonard N. Stern School of Business, Kaufman Management Center, NYU “Who Borrows from the Lender of Last Resort?”. (3:45 – 4:35 pm)

Discussant: Jennie Bai (Georgetown University) (4:35 – 4:50 pm)

Audience Q&A. (4:50 – 5:00 pm)

Over 100 Participate in Business Career Center “Biz-Nite” Event

Storrs, Conn.– On the evening of February 19, more than 100 School of Business students participated in “Biz-Nite,” the Business Career Center’s spring career event. The program included 35 corporate professionals from 16 companies who engaged students in presentations about the job market as well as full-time and internship positions.

Storrs, Conn.– On the evening of February 19, more than 100 School of Business students participated in “Biz-Nite,” the Business Career Center’s spring career event. The program included 35 corporate professionals from 16 companies who engaged students in presentations about the job market as well as full-time and internship positions.

The presentations were held at the School of Business in Storrs, Connecticut where there was a palpable energy as employers’ marketing banners lined the hallways. Steve Wolfberg ’81 (CLAS), principal and chief creative officer at Cronin and Company Marketing Communications, had this to say about the event:

“Biz-Nite was a great experience. UConn School of Business students are smart, prepared and curious. Hopefully they learned as much from me as I did from them.”

In addition to top key corporate partners, the evening also welcomed new presenters from the Boston Celtics, CareCentrix, Bouvier Insurance, and Cronin and Company. “Biz-Nite had a variety of employers, and as a student, I was able to hear about companies and the opportunities at them as well as talk with recruiters and have an informal interview,” said Nicole Nonnenmacher ’16.

Before, during and after the information sessions, students were able to network with business professionals and to deepen relationships developed at the Fall Career Expo.

At the end of the evening all students who had attended two or more sessions were entered into a drawing for two tickets to a Celtics basketball game at the TD Garden in Boston, Massachusetts. A junior MIS student was the lucky winner of the tickets, which were generously donated by Jillian Paine, inside sales manager of the Boston Celtics.

Pictured: Steve Wolfberg and Lindsey Wolejko, Cronin & Company, with School of Business students.

2014 Alumni Hall of Fame Inductees Announced

Storrs, Conn.– Induction ceremony set for May 2nd at Hartford Marriott Downtown.

On May 2, 2014, a distinguished group of business leaders and alumni will be inducted into the University of Connecticut School of Business Alumni Hall of Fame.

The 2014 Hall of Fame Inductees are:

James V. Agonis ’71

Chief Executive Officer and President, Retired, AirKaman Cecil, Inc.

Jacksonville, FLKevin A. Bouley ’80

President and Chief Executive Officer, Nerac, Inc.

Tolland, CTBrigadier General James S. Creedon ’53, USAF, Retired

President, Creedon Consulting, LLC

Litchfield Park, AZJoann L. DeBlasis ’76, ’83 MBA

President, Accident & Health Division, Navigators Re.

Ridgefield, CTAmy J. Errett ’79

Chief Executive Officer and Co-Founder, Madison Reed

San Francisco, CALisa R. Klauser ’90

President, Consumer & Shopper Marketing, Integrated Marketing Services

Upper Saddle River, NJ

The School of Business Hall of Fame recognizes alumni who have achieved outstanding success in their business careers, made significant impact on their industry or field of business and have been actively involved in their communities.

“We are pleased to honor and recognize this year’s inductees for their business excellence, professional achievements and extraordinary public service,” said John Elliott, dean of the UConn School of Business. “They are truly inspiring individuals and set a great example for the next generation of business leaders.”

The 2014 honorees join more than 100 individuals previously inducted into the Hall of Fame since its inception in 1993.

This year’s induction takes place on Friday, May 2nd at the Marriott Hartford Downtown at 200 Columbus Boulevard at 6:00 p.m.

Reservations and sponsorship information can be obtained by contacting the School of Business Office of Alumni Relations at frances.graham@business.uconn.edu or (860) 486-0315.