Storrs, Conn. – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Storrs, Conn. – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Finance researchers and practitioners both use the event study method to measure whether the announcement of new information has a statistically significant effect on a firm’s stock market value. Paul Borochin and Joseph Golec, professors of finance at the University of Connecticut, recently proposed a method that uses stock and option prices to account for the degree of investor anticipation of an event to therefore more accurately measure the full value effect of that event.

“The purpose of our study is to introduce a general method of estimating the degree of investor anticipation applicable to all significant events that affect firms with traded options,” says Borochin. “We apply this more general method to estimate probabilities to a complex event: U.S. House of Representatives passage of the healthcare reform law, the Patient Protection and Affordable Care Act of 2010 (PPACA). We also examine a related event with different potential for investor anticipation: the subsequent 2012 Supreme Court ruling on PPACA constitutionality, which was potentially a greater surprise due to the Court’s higher opacity.”

Borochin and Golec essentially interpret the financial market as a betting market. “…we get the same information from options prices that we could obtain from looking at the Intrade [or other betting market] website,” says Borochin.

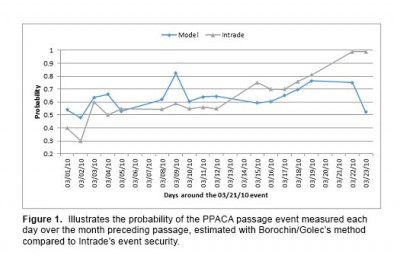

“Indeed, one reason that we select PPACA passage to illustrate our method is that it also had event securities traded on Intrade, the leading prediction market at the time,” he says. “We compare the Intrade-generated probabilities for the 2010 and 2012 events to those we generate from options and stock prices as a robustness check. Our financial market-generated probabilities have two advantages over prediction market-generated probabilities: (1) they are derived from assets with much larger dollar volumes of trades,1 and (2), they can be estimated for any event that impacts companies with traded stock options.”

Borochin and Golec believe that their method could be useful for ex ante as well as ex post public policy analysis, citing legislation that often contains offsetting provisions negotiated among different political factions—in this case, the PPACA fee (tax) on brand name pharmaceutical sales.

They measure the effects ex post, but the method could be used for ex ante analysis by government or industry officials. “For example, Congress could publicly release a bill and a vote date. Based on the option market reaction to the vote announcement, both government and industry officials could determine investors’ estimates of the net effect of the bill’s provisions,” says Borochin.

“Our method could also be used to better estimate public or private damages associated with an event,” he adds. “The Securities and Exchange Commission often estimates damages from corporate fraud and the Federal Trade Commission estimates damages from illegal business practices. As long as some of the firms involved have traded stock and options, our method can give a more accurate estimate of total damages.”

Many event studies do not adjust for the fact that their events are partly anticipated, and in many cases, the degree of anticipation is difficult to measure. For the PPACA House vote event Borochin and Golec consider, the adjustment triples the measured effect of the event on the market value of the affected firms.

“We believe that [our method] is likely to be more precise than alternative methods such as using public data on firm-specific attributes to estimate event probabilities, or using event securities from relatively small prediction markets, because our method employs high-volume assets whose prices may partly reflect nonpublic information. For an event with substantial public information available (House passage), we find our probability estimate and that of a prediction market are quite close. But for an event with little public information (Supreme Court constitutionality), the estimates differ considerably,” said Borochin.

The working paper, “Using Options to Measure the Full Value-Effect of an Event: Application to the Healthcare Reform Act,” can be downloaded here.

>>More about this research

1The daily value of PPACA contracts on Intrade averaged about $90,000 around the 2010 House vote event, while the average daily dollar value of stock ($277 million) and notional value of options ($397 million) traded for each company in our model totaled $674 million. The daily Intrade value was $35,000 during the 2012 Supreme Court event, while the average dollar stock and notional options trade value was $640 million.

Figure 1 –

The model-generated probability of PPACA passage compared to the Intrade-generated probability.

This figure plots the model-generated probability of PPACA passage by the U.S. House of Representatives, which is the probability implied by the stock and options prices of six hospital firms and six insurance firms. The Intrade-generated probability of PPACA passage is the price of an event security traded on the Intrade prediction market. Probabilities are shown for three weeks of trading before the event, the event day (March 22, 2010), and the day following the event.

A professor at the UConn Center for Real Estate and Urban Economic Studies was recently admitted to practice law before the United States Supreme Court. Attorney Lucy Michaud, whose areas of expertise are real estate and business law, has been working with the real estate center at the School of Business as asst. ext. professor and a liaison to the Department of Consumer Protection.

A professor at the UConn Center for Real Estate and Urban Economic Studies was recently admitted to practice law before the United States Supreme Court. Attorney Lucy Michaud, whose areas of expertise are real estate and business law, has been working with the real estate center at the School of Business as asst. ext. professor and a liaison to the Department of Consumer Protection.