UConn School of Business doctoral student Mark Schneider has won the 2014 Decision Analysis Society Student Paper Award for a work he solo authored. His paper is titled, “Frame Dependent Utility Theory” and it presents a model of decisions under risk which is based on emerging evidence from the neuroscience of decision making. The model generalizes expected utility theory by explicitly modeling how choices are framed and how different frames systematically elicit different preferences. A simple preference foundation for the model is provided, and it is demonstrated that the model resolves important empirical violations of rational choice theory. Schneider, a resident of Mansfield, will receive his award at a meeting in San Francisco in November.

Faculty

Professors Gilson, Mathieu Win Best Paper Awards

Faculty and Ph.D. students in the School of Business’ management department have been selected for two prestigious awards in recent weeks.

The Journal of Occupational and Organizational Psychology (JOOP) recently recognized a paper titled “Unpacking the Cross-level Effects of Tenure Diversity, Explicit Knowledge, and Knowledge Sharing on Individual Creativity,” as Best Paper for 2013. The paper was co-authored by UConn graduate students Margaret Luciano and Hyoun Sook Lim and Professor of Management Lucy Gilson. Continue Reading

The Journal of Occupational and Organizational Psychology (JOOP) recently recognized a paper titled “Unpacking the Cross-level Effects of Tenure Diversity, Explicit Knowledge, and Knowledge Sharing on Individual Creativity,” as Best Paper for 2013. The paper was co-authored by UConn graduate students Margaret Luciano and Hyoun Sook Lim and Professor of Management Lucy Gilson. Continue Reading

School of Business Welcomes 14 New Faculty Members for Fall 2014

The UConn School of Business has welcomed 14 new faculty members to its ranks this fall. “It was a very competitive year,” said Dean John A. Elliott. “We were able to hire a diverse group of women and men, including experienced faculty members and newer Ph.D. graduates. We have some senior educators, and some junior; all are excellent.”

View new faculty profiles here.

2014 AOM Best Paper in Healthcare Management Award

Lauren D’Innocenzo (PhD ‘14) Assistant Professor, Drexel and Margaret Luciano (MGMT ABD), co-authors: Travis Maynard (Ph.D. ’07) Associate Professor, Colorado State; John Mathieu Professor of Management, UConn; Gilad Chen, Professor of Management, Maryland, won the 2014 “Best Paper in Healthcare Management Award” at Academy of Management. “Empowered to Perform: A Multi-level Investigation of Empowerment on Performance in Hospital Units.” (A version of it is R&R at AMJ!)

JOOP Best Paper for 2013

Margaret Luciano (MGMT ABD), Hyoun Sook Lim (MGMT ABD), and Lucy Gilson, Professor of Management, UConn was selected as the Best Paper for 2013 in Journal of Occupational and Organizational Psychology (JOOP). ” Unpacking the cross-level effects of tenure diversity, explicit knowledge, and knowledge sharing on individual creativity” will be featured JOOP’s website and include an announcement in an upcoming issue.

David Bergman Receives Prestigious Association for Constraint Programming Doctoral Thesis Award

David Bergman, an assistant professor of Operations and Information Management in the School of Business, has been selected as the winner of this year’s Association for Constraint Programming Doctoral Thesis Award.

David Bergman, an assistant professor of Operations and Information Management in the School of Business, has been selected as the winner of this year’s Association for Constraint Programming Doctoral Thesis Award.

The annual award is given to a researcher who has completed his/her thesis in the area of constraint programming. Bergman will present his thesis at this year’s 20th International Conference on Principles and Practices of Constraint Programming in Lyon, France, in September.

Bergman’s thesis is titled, “New Techniques for Discrete Optimization,” and it explores new methodological approaches to discrete optimization problems, an area of operations research which finds an increasing number of applications in fields such as finance, healthcare, and logistics, to name just a few. His thesis provides both theoretical insights and important algorithmic discoveries which together improve upon existing state-of-the-art technology.

He completed his Ph.D. in 2013 at Carnegie Mellon University in Algorithms, Combinatorics, and Optimization, a joint program administered by the Tepper School of Business, the Department of Mathematical Sciences, and the Computer Science Department. Bergman’s thesis advisors were John N. Hooker and Willem-Jan van Hoeve.

An abstract of “New Techniques for Discrete Optimization” is available here.

Message from the Dean (Summer 2014)

What should a modern business education encompass?

Innovation, Sustainability, Analytics Top List of Academic Strategies

This article first appeared in the UConn Business magazine, Volume 4, Issue 3 (Summer 2014)

Education is a truly transformative experience.

While it is incumbent upon our students to take advantage of the many wonderful opportunities they have here at UConn, we—the administrators, faculty and staff—have an equally formidable responsibility.

Education is never stagnant. We must be mindful of the changing business climate, tap the expertise and perspective of our business partners, and consistently deliver the knowledge and skills that our students require.

We must embrace change. This year the School of Business will adopt a new academic vision to guide us in our preparation of future entrepreneurs, executives and decision-makers.

In consonance with the University of Connecticut’s newly adopted academic vision, “Creating our Future: UConn’s Path to Excellence,” we have identified the following four areas for emphasis: creativity, innovation and entrepreneurship; sustainability and risk management; analytics and big data; and healthcare management and insurance studies. All are vital to economic growth and solving the world’s problems, be they personalized medicine and genomics, data management or protecting our planet. These areas of emphasis help focus our attention and guide our growth. They engage us with our business community. However, they do not mean we are turning away from the core functional education that our students seek and our business partners rely upon in the traditional areas.

At the UConn School of Business, we strive to be a globally-recognized provider of exceptional managerial and business leadership. We believe that academic excellence in a modern business education requires a global perspective. Our many goals include identifying and addressing business challenges and recognizing our role as a partner in the success of business development both in Connecticut and beyond. We believe our new academic vision will keep us sharply focused on those goals.

In this issue of UConn Business, we have the opportunity to introduce you to a very special family whose generosity will enable us to continue to invite the most deserving students to our ranks.

Denis ’76 CLAS, ’77 MBA and Brita Nayden ’76 have donated $3 million towards the new UConn Basketball Champions Center and for scholarships for student-athletes, with a very generous amount earmarked for School of Business students.

The School honors remarkable individuals by induction into the School of Business Hall of Fame. Denis Nayden has already earned this distinction. In this issue you will also enjoy reading about five of our remarkable alumni whose business accomplishments, character, and dedication to others have recently earned them similar recognition.

While each of their passions and stories is unique, I’m sure they share the mantra of alumna Amy J. Errett ’79 (CLAS), an entrepreneur, senior executive, venture capitalist and philanthropist. When asked how she accomplishes so much, she said: “Well, I don’t sleep a lot … I get up early and go to bed late, and I try to make every day count.”

Our Storrs campus is bustling with the addition of headquarters for the Connecticut Small Business Development Center, now located on the second floor of the School of Business. The CTSBDC provides free, confidential, business advising to entrepreneurs who are forming or growing a business. We certainly believe this partnership will be advantageous for our students, our university, and many businesses throughout Connecticut.

As the summer draws to a close, the School of Business faculty and staff are excited for this academic year. Always a busy time, this year it is even more so, as we usher in new programs in Human Resource Management and in Digital Marketing & Analytics, a rapidly growing field with tremendous employment opportunities.

Best wishes to all,

John A. Elliott

Dean and Auran J. Fox Chair in Business

UConn Finance Professors Propose New Method to Estimate the Full Value-Effect of an Event

Storrs, Conn. (5/20/2014) – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Storrs, Conn. (5/20/2014) – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Finance researchers and practitioners both use the event study method to measure whether the announcement of new information has a statistically significant effect on a firm’s stock market value. Paul Borochin and Joseph Golec, professors of finance at the University of Connecticut, recently proposed a method that uses stock and option prices to account for the degree of investor anticipation of an event to therefore more accurately measure the full value effect of that event.

“The purpose of our study is to introduce a general method of estimating the degree of investor anticipation applicable to all significant events that affect firms with traded options,” says Borochin. “We apply this more general method to estimate probabilities to a complex event: U.S. House of Representatives passage of the healthcare reform law, the Patient Protection and Affordable Care Act of 2010 (PPACA). We also examine a related event with different potential for investor anticipation: the subsequent 2012 Supreme Court ruling on PPACA constitutionality, which was potentially a greater surprise due to the Court’s higher opacity.”

Borochin and Golec essentially interpret the financial market as a betting market. “…we get the same information from options prices that we could obtain from looking at the Intrade [or other betting market] website,” says Borochin.

“Indeed, one reason that we select PPACA passage to illustrate our method is that it also had event securities traded on Intrade, the leading prediction market at the time,” he says. “We compare the Intrade-generated probabilities for the 2010 and 2012 events to those we generate from options and stock prices as a robustness check. Our financial market-generated probabilities have two advantages over prediction market-generated probabilities: (1) they are derived from assets with much larger dollar volumes of trades,1 and (2), they can be estimated for any event that impacts companies with traded stock options.”

Borochin and Golec believe that their method could be useful for ex ante as well as ex post public policy analysis, citing legislation that often contains offsetting provisions negotiated among different political factions—in this case, the PPACA fee (tax) on brand name pharmaceutical sales.

They measure the effects ex post, but the method could be used for ex ante analysis by government or industry officials. “For example, Congress could publicly release a bill and a vote date. Based on the option market reaction to the vote announcement, both government and industry officials could determine investors’ estimates of the net effect of the bill’s provisions,” says Borochin.

“Our method could also be used to better estimate public or private damages associated with an event,” he adds. “The Securities and Exchange Commission often estimates damages from corporate fraud and the Federal Trade Commission estimates damages from illegal business practices. As long as some of the firms involved have traded stock and options, our method can give a more accurate estimate of total damages.”

Many event studies do not adjust for the fact that their events are partly anticipated, and in many cases, the degree of anticipation is difficult to measure. For the PPACA House vote event Borochin and Golec consider, the adjustment triples the measured effect of the event on the market value of the affected firms.

“We believe that [our method] is likely to be more precise than alternative methods such as using public data on firm-specific attributes to estimate event probabilities, or using event securities from relatively small prediction markets, because our method employs high-volume assets whose prices may partly reflect nonpublic information. For an event with substantial public information available (House passage), we find our probability estimate and that of a prediction market are quite close. But for an event with little public information (Supreme Court constitutionality), the estimates differ considerably,” said Borochin.

The working paper, “Using Options to Measure the Full Value-Effect of an Event: Application to the Healthcare Reform Act,” can be downloaded here.

1The daily value of PPACA contracts on Intrade averaged about $90,000 around the 2010 House vote event, while the average daily dollar value of stock ($277 million) and notional value of options ($397 million) traded for each company in our model totaled $674 million. The daily Intrade value was $35,000 during the 2012 Supreme Court event, while the average dollar stock and notional options trade value was $640 million.

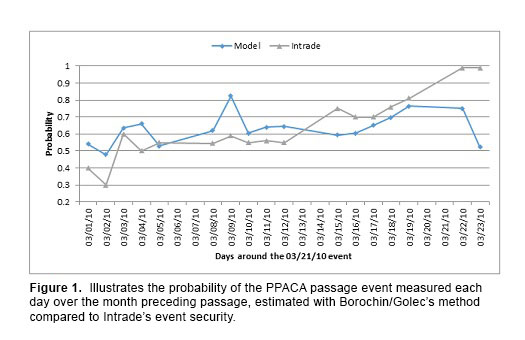

Figure 1 –

The model-generated probability of PPACA passage compared to the Intrade-generated probability.

This figure plots the model-generated probability of PPACA passage by the U.S. House of Representatives, which is the probability implied by the stock and options prices of six hospital firms and six insurance firms. The Intrade-generated probability of PPACA passage is the price of an event security traded on the Intrade prediction market. Probabilities are shown for three weeks of trading before the event, the event day (March 22, 2010), and the day following the event.

Richard E. Hurley Receives National Educator Award

Richard E. Hurley, Ph.D., JD, CPA, CFE, CFF, received the prestigious National Educator Award from the Association of Government Accountants (AGA) on July 17th, 2013. Dr. Hurley’s award was presented at the Association’s Annual Professional Development Conference (PDC) training event in Dallas.

The AGA Educator Award was formally established to recognize an individual who has made significant contributions to educating and training government financial managers for more than two decades.

Dr. Hurley received this award in recognition of his vast contributions to the education and training of accountability professionals and students in advancing financial management. His presentations, courses and writings cover a wide range of accountability topics and his expertise as a practitioner and university professor is quite evident. He consistently receives excellent evaluations of his work and is well-respected in the field of government financial management. Dr. Hurley is a member of the AGA New York Capital Chapter.

Dr. Hurley has been a licensed Certified Public Accountant in the State of New York for 30 years and has also been a licensed Attorney in the State of New York for over 35 years and is licensed to practice before the U.S. Supreme Court and the U.S. Tax Court.

He has written the Fraud Edge column for Fraud Magazine, which is a column devoted to fraud education for the benefit of academics and practitioners, and he currently co-authors a column entitled Global Fraud Focus.

He is also a member of the New York Society of CPAs and is a member of the Forensic Litigation Services Committee of the State Society and a member of the Anti-Money Laundering & Counter Terrorist Financing Committee.

Dr. Hurley has written and presented in the field of accounting and security fraud and auditing issues related to fraud detection and prevention. Dr. Hurley teaches MBA courses in Financial Accounting and Reporting, Financial Statement Analysis, Forensic Accounting & Fraud Examination for the University of Connecticut in Stamford, Connecticut where he has been a professor for 14 years.

Accounting Department Welcomes New Faculty Members

The University of Connecticut has embarked on an ambitious hiring initiative to expand its faculty and senior academic leadership across disciplines, investing in 500 tenure-track faculty positions over the next four years.

As a result of this initiative, the Accounting Department is delighted to welcome two new faculty members in the 2013-2014 academic year. These new faculty bring a diverse array of expertise and research interests to the school and our students.

Paul Glotzer joins the faculty after serving as an adjunct lecturer in the Accounting Department of the UConn School of Business since 2012. Prior to UConn, Paul served as project manager at the Financial Accounting Standards Board (FASB). Prior to FASB, he served as director of accounting and auditing at Shein, Cohen, Palmer & Company, LLC, for twenty years. Paul also worked as a manager at Kostin Ruffkess & Company for ten years subsequent to working as a staff accountant for three years at Troub, Glotzer, & Company.

Paul’s areas of expertise include: U.S. GAAP and its application to financial statement preparation, audits, reviews, and compilations; income tax planning and compliance for corporations, partnerships, and individuals; and payroll and sales taxes. He has also published in the American Institute of Certified Public Accountants’ Journal of Accountancy. In addition to his affiliation with the AICPA, Paul is a very active member in the Connecticut Society of Certified Public Accountants where he currently serves or has served on several committees, including Technical Reviewer and Chair of the Accounting and Reporting Standards Committee; the Board of Governors; Compilation and Review Committee; Professional Ethics Committee; Peer Reviewer; Management of an Accounting Practice Committee and Relations with Secondary School Committee. He was also voted Committee Member of the Year for 2000-2001. Paul is a CPA and graduated with High Honors from the University of Connecticut in 1972 with a Bachelor of Science degree Accounting. He is also the new faculty advisor to the Accounting Society at UConn.

Arthur Schmeiser joins the UConn faculty after serving 38 years at Deloitte & Touche LLP where he retired as a senior partner. Art served clients in a variety of industries but had a focus on clients in consumer businesses such as Macy’s, Neiman Marcus, Procter & Gamble, Saks 5th Avenue, Sears, Talbots, The May Department Stores Company and Timberland. In addition to his client work, he has held various leadership positions within D&T, both domestically and internationally. He has broad experience in Securities and Exchange Commission [including serving as an SEC fellow from 1979 to 1981] and other accounting and reporting requirements having been involved with numerous initial public offerings, secondary offerings, public merger filings and public and private company audits. He has extensive experience dealing with Boards of Directors, Audit Committees and Senior Executives of U.S public companies in accounting and reporting areas, along with strategic acquisition and other business matters.

Art is a member of the American Institute of Certified Public Accountants, as well as the Society of Certified Public Accountants in the states of Connecticut and New York. Art earned a Bachelor of Science degree in Accounting from St. John’s University in 1971.