Brookfield, Wis. and Hartford, Conn. – Fiserv, Inc. (NASDAQ: FISV), a leading global provider of financial services technology solutions, and the University of Connecticut School of Business, one of the top public business schools in the nation, today announced that Fiserv is participating in the university’s Financial Accelerator Program to help educate students and foster innovation. Continue Reading

Year: 2014

Alumni Mentorship Program Forging Professional Relationships

The Alumni Mentorship Program, a collaboration between the School of Business Office of Alumni Relations and the Business Career Center, is actively creating opportunities for students to make professional relationships for a lifetime.

The Alumni Mentorship Program, a collaboration between the School of Business Office of Alumni Relations and the Business Career Center, is actively creating opportunities for students to make professional relationships for a lifetime.

Connecting over 100 students one-on-one with alumni in their chosen field, the program spans four cities – Hartford, Conn., Stamford, Conn., New York, New York, and Boston, Mass. Mentoring activities include scheduled phone conversations, email exchanges, informational interviews, half/full day job shadowing, and networking meeting events. Over the 2013-14 academic year, mentors and mentees connected at two networking dinners that are planned again for this coming fall. Most recently, students connected with the alumni volunteers at “speed mentoring” events in Hartford and Stamford. See photos.

Launched in 2011, the program was designed to connect top School of Business students with alumni mentors in business who are committed to building a strong mentoring relationship in aiding students in launching their career. Discussions help the students to learn about opportunities that could broaden their education and knowledge of their chosen field, explore their strengths and weaknesses, and to learn how to communicate effectively in networking situations and build a solid network.

Alumni who are interested in volunteering or hearing more about this rewarding way to give back are encouraged to reach out to Fran Graham in the Alumni Relations Office at fran.graham@business.uconn.edu.

School of Business students who wish to apply for the program are asked to reach out to Kelly Kennedy in the Business Career Center at kelly.kennedy@business.uconn.edu.

Pictured: A student chats with Michael Golden ’84, strategic relationship manager for Fireman’s Fund Insurance Company.

UConn Finance Professors Propose New Method to Estimate the Full Value-Effect of an Event

Storrs, Conn. – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Storrs, Conn. – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Finance researchers and practitioners both use the event study method to measure whether the announcement of new information has a statistically significant effect on a firm’s stock market value. Paul Borochin and Joseph Golec, professors of finance at the University of Connecticut, recently proposed a method that uses stock and option prices to account for the degree of investor anticipation of an event to therefore more accurately measure the full value effect of that event.

“The purpose of our study is to introduce a general method of estimating the degree of investor anticipation applicable to all significant events that affect firms with traded options,” says Borochin. “We apply this more general method to estimate probabilities to a complex event: U.S. House of Representatives passage of the healthcare reform law, the Patient Protection and Affordable Care Act of 2010 (PPACA). We also examine a related event with different potential for investor anticipation: the subsequent 2012 Supreme Court ruling on PPACA constitutionality, which was potentially a greater surprise due to the Court’s higher opacity.”

Borochin and Golec essentially interpret the financial market as a betting market. “…we get the same information from options prices that we could obtain from looking at the Intrade [or other betting market] website,” says Borochin.

“Indeed, one reason that we select PPACA passage to illustrate our method is that it also had event securities traded on Intrade, the leading prediction market at the time,” he says. “We compare the Intrade-generated probabilities for the 2010 and 2012 events to those we generate from options and stock prices as a robustness check. Our financial market-generated probabilities have two advantages over prediction market-generated probabilities: (1) they are derived from assets with much larger dollar volumes of trades,1 and (2), they can be estimated for any event that impacts companies with traded stock options.”

Borochin and Golec believe that their method could be useful for ex ante as well as ex post public policy analysis, citing legislation that often contains offsetting provisions negotiated among different political factions—in this case, the PPACA fee (tax) on brand name pharmaceutical sales.

They measure the effects ex post, but the method could be used for ex ante analysis by government or industry officials. “For example, Congress could publicly release a bill and a vote date. Based on the option market reaction to the vote announcement, both government and industry officials could determine investors’ estimates of the net effect of the bill’s provisions,” says Borochin.

“Our method could also be used to better estimate public or private damages associated with an event,” he adds. “The Securities and Exchange Commission often estimates damages from corporate fraud and the Federal Trade Commission estimates damages from illegal business practices. As long as some of the firms involved have traded stock and options, our method can give a more accurate estimate of total damages.”

Many event studies do not adjust for the fact that their events are partly anticipated, and in many cases, the degree of anticipation is difficult to measure. For the PPACA House vote event Borochin and Golec consider, the adjustment triples the measured effect of the event on the market value of the affected firms.

“We believe that [our method] is likely to be more precise than alternative methods such as using public data on firm-specific attributes to estimate event probabilities, or using event securities from relatively small prediction markets, because our method employs high-volume assets whose prices may partly reflect nonpublic information. For an event with substantial public information available (House passage), we find our probability estimate and that of a prediction market are quite close. But for an event with little public information (Supreme Court constitutionality), the estimates differ considerably,” said Borochin.

The working paper, “Using Options to Measure the Full Value-Effect of an Event: Application to the Healthcare Reform Act,” can be downloaded here.

1The daily value of PPACA contracts on Intrade averaged about $90,000 around the 2010 House vote event, while the average daily dollar value of stock ($277 million) and notional value of options ($397 million) traded for each company in our model totaled $674 million. The daily Intrade value was $35,000 during the 2012 Supreme Court event, while the average dollar stock and notional options trade value was $640 million.

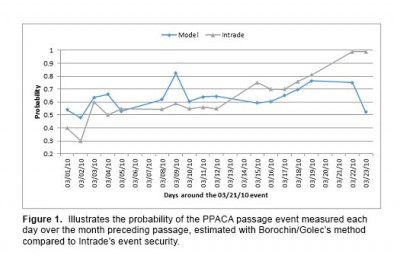

Figure 1 –

The model-generated probability of PPACA passage compared to the Intrade-generated probability.

This figure plots the model-generated probability of PPACA passage by the U.S. House of Representatives, which is the probability implied by the stock and options prices of six hospital firms and six insurance firms. The Intrade-generated probability of PPACA passage is the price of an event security traded on the Intrade prediction market. Probabilities are shown for three weeks of trading before the event, the event day (March 22, 2010), and the day following the event.

UConn ups business on the syllabus

“In a lightning-fast economy, universities must constantly adapt to the shifting job market by adding and subtracting courses, instructors and professional degrees, all while maintaining budget. Over the past several years, The University of Connecticut in Stamford has been responding to the job market by expanding its business school programs and strengthening its ties with the business community…

UConn Business School Executive Director Jud Saviskas said there’s been a definitive growth in the college and the business community plays a big role in providing direct input into that growth. Three new business programs have emerged in just four years

Four years ago, the business school launched a master’s degree program in financial risk management. Last fall, it started an undergraduate financial management program.

The one-year graduate program in financial risk management, which is offered in both the Hartford and Stamford campuses, grew from 23 students total in 2010 to 86 students [in Fall 2012]. The enrollment number is expected to reach 140 this fall.”

The full article from insurancenewsnet.com, written by Crystal Kang (May 19, 2014) may be found here.

A Visit from the FASB, CTCPA, and CT State Board of Accountancy

The online MS in Accounting Program held its four day in-residence class, Acct 5505, from May 19-22, welcoming 100 new students to UConn. One highlight from the week was a session called “Steering the Profession,” which included a presentation by Jeremie Richer of the FASB about the FASB’s role in the accounting profession. Joining Jeremie in the workshop were Mark Zampino from the CT Society of CPAs, and Sonia Worrell Asare and Stephanie Sheff from the CT State Board of Accountancy. They provided an overview of how their state-based organizations can help accountants in their work. In addition, they discussed the requirements for continuing professional education for Connecticut, pointing out that each state has its own requirements.

A big thank you to Jeremie, Mark, Sonia, and Stephanie for their time and expertise.

Project Management Certification Training for Veterans Approved

Stamford, Conn. – The Connecticut Office of Higher Education / State Approving Agency has approved project management certification training for veterans and other eligible U.S. Department of Veterans Affairs beneficiaries at UConn’s Stamford campus, effective immediately.

Stamford, Conn. – The Connecticut Office of Higher Education / State Approving Agency has approved project management certification training for veterans and other eligible U.S. Department of Veterans Affairs beneficiaries at UConn’s Stamford campus, effective immediately.

University of Connecticut’s School of Business and their component for non-credit programs, Connecticut Information Technology Institute (CITI), have been authorized to provide project management certification training under the provisions of Title 38 Section 3675, United States Code of Federal Regulation for Veterans program.

The Project Management Institute (PMI)® has designated CITI as a “Global Registered Education Provider (R.E.P.)” This signifies that CITI has met PMI’s rigorous standards of quality curriculum and instruction for project management training.

CITI’s project management curriculum includes certification training programs for project practitioners of all education and skill levels. The Certified Associate in Project Management (CAPM)® is a good entry-level certification for those who are new to project management. The Project Management Professional (PMP)® is the most important globally-recognized and independently validated credential for experienced project managers.

Course offerings related to these and other credentials are offered at CITI on a monthly basis. Research studies have proven that project management certifications can positively impact project manager salaries, and help them stand out to prospective employers in the marketplace.

All of CITI’s Project Management Courses are approved for Professional Development Units, as well Education Development Units.

For more information, go to www.citi.uconn.edu or call (203) 251-9516.

International Business Society Visits Thomson Reuters

Each year, the International Business Society participates in an annual corporate visit to gain access to, tour, and learn more in-depth about a particular company. This spring, the society’s trip was to Thomson Reuters in Times Square, New York.

Each year, the International Business Society participates in an annual corporate visit to gain access to, tour, and learn more in-depth about a particular company. This spring, the society’s trip was to Thomson Reuters in Times Square, New York.

Thomson Reuters was chosen because of its high level of interaction in the international business world. The company serves a global customer base as the world’s leading source of intelligent information for businesses and professionals.

“The students met with Benjamin Goodband, VP of Investor Relations, and learned about Thomson Reuters’ business structure, company culture, and methods for product development,” said Kelly Kennedy, career coach and instructor at the School of Business Career Center.

The students also received an in-depth introduction to one of Thomson Reuters’ products and a demonstration of how it impacts business decisions in real-time.

“Exposure to Thomson Reuters has given us a fresh, in-depth perspective on how international business is conducted in this ever-evolving business environment,” said Courtney Hong, one of the students who participated in the tour.

Students interested in joining the International Business Society can reach out to uconnibs@gmail.com.

Companies who may wish to host a visit from some of our best and brightest business school students are encouraged to contact Kelly Kennedy at kelly.kennedy@business.uconn.edu.

Pictured: Students Caroline Warren, Patience Bearse, Sarah Biedermann, Dana Cho, Courtney Hong, Erica Hanner, and Kelly Kennedy from the Business Career Center.

Employees Recognized for Years of Service

Dean John Elliott and Associate Deans Sulin Ba, Larry Gramling, and George Plesko recognized employees for their years of service to the University and the State of Connecticut on Friday, May 2, 2014. The Employee Recognition Reception was held in the School of Business Board Room.

The employees recognized were: Continue Reading

Domestic Students Now Allowed Part-Time Option

Important Change for Domestic Students

(Effective Immediately)

The MsFRM program now allows domestic students both full-time and part-time options. The course sequence under the full time option is as follows:

Full-Time Option

- Fall I – 2 courses

- Spring I – 3 courses

- Summer I – 3 courses

- Fall II – take 3 courses

Total – 11 courses (33 credits)

Graduation in the December of following year.

All course are lock-step and must be taken in sequence

Part-Time Option

Under the part-time option, students are allowed the maximum possible flexibility to take as many or few courses as they wish every semester. However, courses are still lock-step and part-time students must wait until the course is offered again next academic year.

A suggested sequence of courses for part-time students is as follows:

- Fall I – 2 courses

- Spring I – any 2 courses (should take Fin Modeling II)

- Summer I – any 2 courses (should take Fin Modeling III)

- Fall II – 3 courses

- Spring II – 1 remaining course from Spring I

- Summer II – 1 remaining course from Summer I

Total – 11 courses (33 credits)

Graduation in the May of second year.

All course are lock-step and must be taken in sequence

Under the above Part Time scheme, part-time students will graduate in May of second year.

However, the program allows the students the maximum possible flexibility to choose as many or few courses as the part-time student wishes, subject to the following caveats:

- Domestic students will be allowed to take as many (not exceeding 3) or as few (including not taking any course) courses they choose during each semester.

- All domestic students are strongly advised to take at least one course each semester.

- All domestic students are strongly advised to take the Financial Modeling course sequence before they take the Financial Risk Management sequence, to the extent possible.

- Domestic students must finish the experiential learning project with the group to which he/she is assigned.

- All domestic students are strongly advised to finish the program within 2 years.

- All domestic students must finish the program (33 credits for the 15 month, 42 credits for the 20-month program) within 3 years from starting the program.

***Important – Students need to take a certain number of credits to be eligible for financial aid and to not have to repay loans. Students should be careful about their funding availability if they choose to take less credits per semester. Students are responsible to check with Financial Aid Office regarding this issue.

The part-time option is available to all domestic students with immediate effect, meaning current domestic students can take advantage of this change from this summer. Please also note that the current students choosing the part-time option will have to wait until next year when the same courses will be offered again, unless the course sequence is changed in which case they will be informed immediately.

Alumni News & Notes (Spring 2014)

This article first appeared in the UConn Business magazine, Volume 4, Issue 2 (Spring 2014)

* Links direct to the Business Alumni Network

1960s

Scott S. Cowen ’68, ’10H has been awarded the 2014 TIAA-CREF Hesburgh Award for Leadership Excellence. Cowen and his wife, Marjorie, were also recently awarded the Hannah G. Solomon Award by the National Council of Jewish Women.

1970s

Robert J. Genise ’75 MBA has been appointed as an independent board member at Frontier Airlines. Genise is currently chairman of the board of PCA Aerospace and chief executive officer of Aergen, LLC.

James F. Klotz ’77 has been appointed to vice president, claims strategic operations systems at Selective Insurance Group. Mr. Klotz has held positions such as senior vice president and chief information officer at PMA Insurance and vice president of information systems at Travelers.

Robert E. Schneider ’79 MBA has been appointed to second vice president, compensation at The Phoenix Companies. Mr. Schneider will manage general and executive compensation programs for the company.

1980s

Claire R. Fennessey ’86 joined Clarus Marketing Group as the chief marketing officer. Ms. Fennessey has over 20 years of marketing experience and most recently she was the president of Palm Publishing.

Daniel A. Migliaro ’88 has been named vice president, commercial business development officer, at Newtown Savings Bank. Mr. Milagro also serves as a board member of the Connecticut Business Development Corporation.

William M. Nelson ’87 MBA has been named as the manager for high income funds at Ivy Funds. Mr. Nelson is also a portfolio manager of Ivy Funds VIP High Income and Waddell & Reed Advisors High Income Fund.

Steven C. Snelgrove ’80 has been named president of Howard County General Hospital, a Johns Hopkins Medicine member institution.

Gregory J. Trudel ’83 has been appointed to president and CEO of Encision Inc. Most recently he was the global director of marketing within a division within the Surgical Solutions Group at Covidien.

Rita J. Ugianskis-Fishman ’88, ’95 MBA has been named vice president and general manager of The ASI Show. Ms. Ugianskis-Fishman was most recently managing director of Penton’s Waste Industry Group and is an accomplished trade show executive.

Anne M. Wilkins ’88 has joined AllazoHealth as an advisory board member. Ms. Wilkins has more than 20 years of healthcare experience with a long history of leadership in population health management.

1990s

Jonathan R. Collett ’95 has been elected to partner at CohnReznick in Glastonbury, Connecticut. Mr. Collett is a certified public accountant and is a member of the firm’s financial services industry practice group.

Matthew D. Danyliw ’99 has been appointed to senior vice president of Khamelon Software, Inc. Prior to his appointment at Khameleon, Mr. Danyliw was chief financial officer of Office Furniture, Inc.

Lyle T. Fulton ’94 MBA has joined Guilford Savings Bank as the vice president, commercial loan officer. Mr. Fulton is a seasoned commercial lender in northern Connecticut with over 25 years of experience.

John Y. Kim ’87 MBA has been elected a vice chairman of New York Life. Mr. Kim will now oversee the company’s technology function. He is currently the president of New York Life’s Investments Group.

Anthony A. Licata ’95 has been appointed chief operating officer by Morgan Lewis & Bockius. Prior to his appointment at Morgan Lewis & Bockius, Mr. Licata was chief operating officer at Dechert.

Luigi A. Peluso ’93 MBA has been named managing director of the enterprise improvement group at AlixPartners. Prior to his appointment at AlixPartners, Mr. Peluso served as senior vice president of operations at Hitachi Consulting Inc.

Thomas P. Trutter ’99 MBA received the 2013 Construction Industry Recognition Award from Associated General Contractors of Connecticut. Mr. Trutter is currently UConn Health Center’s associate vice president of campus planning, design, and construction.

2000s

Adam B. Camara ’03 is the co-founder of the national internet marketing firm, Network for Solutions.

Joshua J. Gopan ’02 has been appointed as director of leasing of Hutchinson Metro Center. Mr. Gopan previously worked at Colliers International where he served as a leasing specialist and managing director.

Greg Oshins ’05 MBA has been promoted to vice president of investments at National Realty & Development Corporation. Mr. Oshins has been at NRDC since 2006 when he was a member of the acquisitions and development team as well as the company’s leasing team.

Amanda H. Wallace ’07 MBA has been recognized as a 2013 Working Mother of the Year for representing the best in working motherhood as well as for her outstanding leadership ability. Ms. Wallace is the assistant vice president of strategy and planning for the U.S. insurance business at MassMutual.

2010s

Ryan G. Demadis ’11 has been appointed to vice president, associate producer at NorthMarq. Prior to his appointment at NorthMarq, Mr. Demandis was an associate broker at RM Bradley. He is also the co-founder/director of fundraising for RiseUp Leadership Development Program which provides financial support and mentoring for inner city youth.

Lauren D’Innocenzo ’14 Ph.D. successfully defended her dissertation titled, “Predicting Leader Role Occupance: An Exploration of Shared Leadership Emergence in Project Teams”. Dr. D’Innocenzo accepted a position as assistant professor of management at Drexel University.

Erin Henry ’14 Ph.D. successfully defended her dissertation titled, “The Information Content of Tax Expense: A Firm- and Market-Level Return Decomposition.” Dr. Henry has accepted a tenure-track faculty position at the University of Tennessee.

Bryan P. Schmutz ’13 Ph.D. successfully defended his dissertation titled “Essays on Life Insurance and Healthcare Finance.” Dr. Schmutz has accepted a position at Western New England University as an assistant professor of finance.

Claire Simonich ’13 received the Undergraduate Student Award at the UConn Provost’s Awards for Excellence in Public Engagement. Ms. Simonich spent her time at UConn working in the Office of Community Outreach to lead a new Alternative Spring Break trip to Appalachia focused on rural poverty and labor law. She also led an English language tutoring program for international students at UConn.

Marinela Shqina ’11 has been promoted to controller at Arbors of Hop Brook in Manchester, Connecticut. Ms. Shqina is also a member of the Association of Health Care Facilities, Healthcare Financial Management Association and is a non-CPA member of the Connecticut Society of CPAs.

Tingyu Zhou ’14 Ph.D. successfully defended her dissertation titled, “Three Essays on Decision Making Strategies.” Dr. Zhou has accepted a tenure track position as assistant professor at Concordia University in Montreal.

Share Your News

Submit your career, education, marriage, and birth announcements to the Business Alumni Network. Let us know what you’ve been up to!

What is the Business Alumni Network?

The Business Alumni Network is an online tool for connecting and networking with School of Business alumni. Oh, and it’s free.

Get Connected

alumni.business.uconn.edu