The Business Management Society (BMS) recently hosted a case competition with power-tool manufacturer TTI, the parent company of Milwaukee, Ryobi and Hoover. Student turnout was large, drawing participants from BMS, Women and Business, and other business students. They were tasked with evaluating different marketing strategies to increase the company’s brand exposure on campus. Groups took several routes of action including social media, virtual reality, and brand ambassador programs.

After the competition, the judges awarded prizes to three winning teams:

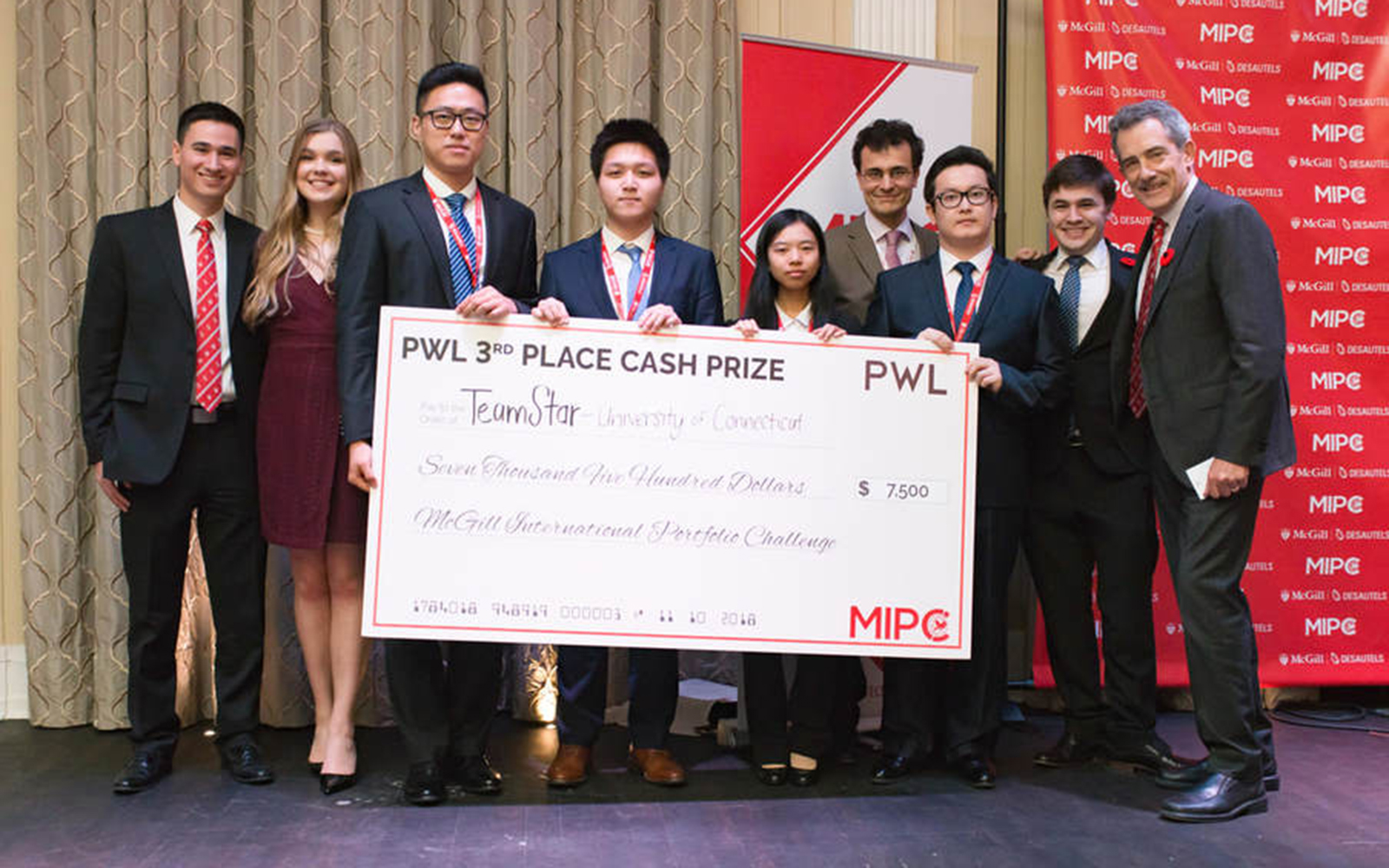

The first place team included: senior Caleb Saleeby (Management), junior Kevin Dean (Management) and senior Michael Boni (Economics). The second-place team included: senior William Simics (Finance); junior Julia Simics (Real Estate), junior Swathy Shriram (Management); and junior Gina Wiezbicki (Marketing). The third place team members were: senior Suxian Kuan (Management); sophomore Tanvi Dandekar (Finance), sophomore Angela Wang (Finance) and junior Emily Curina (Management & Economics).

Ben Morneault, president of BMS, was impressed at the variety of majors and grade levels among student competitions. “Diversity in thought is so often overlooked in case competitions, but these teams understood the importance of diverse teams, and it showed in their solutions,” he said.

The Business Management Society and Women in Business meet on Tuesdays in the School of Business. For more information, please contact Ben Morneault at uconnbms@gmail.com, or Sam Adamo at uconnwomeninbusiness@gmail.com.