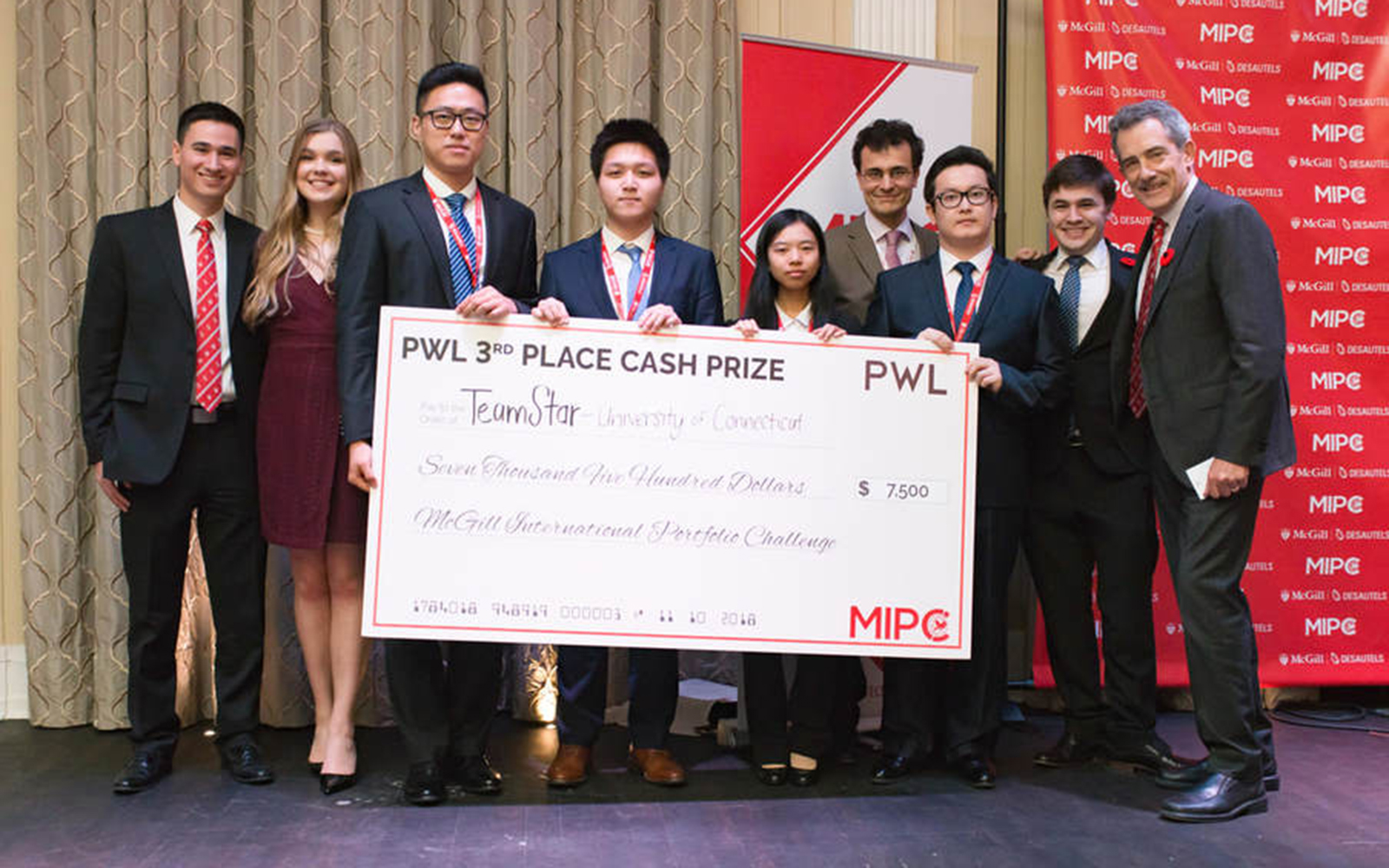

A team of four graduate students in the MS in Financial Risk Management program took third place in an international competition in Montreal earlier this month, and were the highest-placing U.S. team in the competition.

The UConn team included Tuershunjinag Ahemaitijiang, Xiaofan Hou, Junchao Liao and Xiao Wang. Their third-place victory at the McGill International Portfolio Challenge at McGill University in Montreal, bested other top participants from Yale, Columbia, George Washington, University of Chicago, Connecticut College and Chinese University of Hong Kong.

The same group of students were the international champions for the PRMIA Risk Management Challenge in April 2018 in New York City. Wang said the team has been successful because of good communication and cooperation and by allocating tasks that use everyone’s skills and potential.

Their task in the McGill competition was to design an asset allocation strategy for a virtual, underfunded state public pension fund.

“We had to deal with the conflicts of interest from different stakeholders, including member cities unwilling and unable to pay special contributions due to straggling budgets, retired employees who wanted more conservative investment plans, and active employees who wanted more aggressive plans,” Wang said.

“We had to try to maximize the return while also doing risk management to keep risks under control,” Wang said. “Our final solution was to borrow money to relieve the pressure to ask for more contributions from member cities or cut the benefit. We used options to hedge downside risk of our equity investment.”

“Judges liked the idea of using option strategy to protect equity as it is very innovative and unorthodox, and we provided a great deal of valid quantitative evidence to back it up,” Wang said.

The students enjoyed the competition because although the case was contrived, underfunded pension funds pose real problems across the U.S. and Canada.

The competition began with more than 90 teams and the top 25 were selected to present in Montreal. The students were led by faculty advisor and professor Yaacov Kopeliovich and program advisor Jose Aponte.