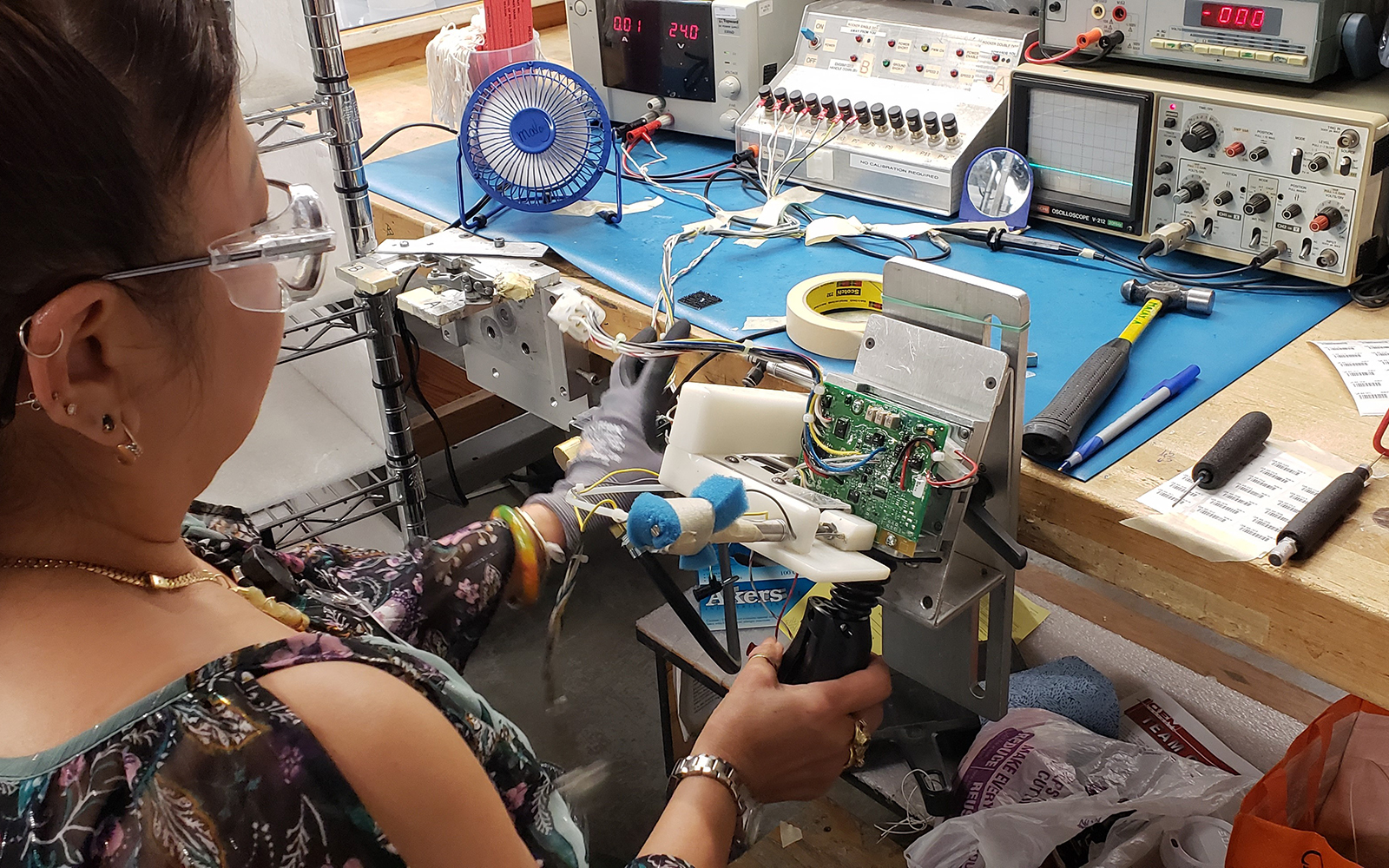

Bottom row, from left: Wei Chen, Redona Methasani ’18 Ph.D., Jo (Kyoungjo) Oh.

Four UConn alumni, high-ranking executives from Anthem and Electric Boat, and professors with ties to Harvard and Yale are among the 14 new faculty joining the UConn School of Business this fall.Continue Reading