Brookfield, Wis. and Hartford, Conn. (5/27/2014) – Fiserv, Inc. (NASDAQ: FISV), a leading global provider of financial services technology solutions, and the University of Connecticut School of Business, one of the top public business schools in the nation, today announced that Fiserv is participating in the university’s Financial Accelerator Program to help educate students and foster innovation.

Brookfield, Wis. and Hartford, Conn. (5/27/2014) – Fiserv, Inc. (NASDAQ: FISV), a leading global provider of financial services technology solutions, and the University of Connecticut School of Business, one of the top public business schools in the nation, today announced that Fiserv is participating in the university’s Financial Accelerator Program to help educate students and foster innovation.

The Financial Accelerator Program was established in 2002 to create opportunities for UConn students and faculty to apply classroom concepts to real business challenges. With the Fiserv initiative, UConn MBA students are collaborating with area business leaders from Fiserv and two of its clients, the Savings Bank of Danbury and Greylock Federal Credit Union, to explore how financial institutions can attract and serve Gen Y consumers using state-of-the-art banking technology.

“The Financial Accelerator Program at the University of Connecticut School of Business shines a spotlight on the exciting and innovative career opportunities available to students in the state,” said Connecticut Governor, Dannel P. Malloy. “Collaborations like this, which bring the leaders of tomorrow together with the leaders of today, foster the innovation and opportunity that help make Connecticut such an attractive place to live and work.”

The initiative, currently underway for the Spring 2014 semester, introduces UConn MBA students to the DNATM account account processing platform from Fiserv. DNA is a modern, enterprise-wide software platform relied upon by Savings Bank of Danbury and Greylock FCU as well as hundreds of other banks and credit unions for transaction processing, data management and customer relationship management. DNA offers a unique development toolkit – DNAcreatorTM – that allows users to create seamlessly integrated applications called DNAappsTM that extend the platform in new and powerful ways. At the conclusion of the Financial Accelerator Program, UConn students will present a business case for a new DNAapp that DNA users like Savings Bank of Danbury and Greylock FCU can use to enhance the millennial banking experience.

“DNA from Fiserv incorporates the latest industry standard tools and languages currently being taught at UConn and other leading universities where banks and credit unions can find a deep and talented pool of software engineers,” said Steve Cameron, president, Open Solutions Division, Fiserv. “By partnering with some of our region’s brightest minds at UConn, the Savings Bank of Danbury and Greylock Federal Credit Union, Fiserv is investing in the local community and continuing to build on our vision to drive the global digital transformation of financial services.”

The students will work with Savings Bank of Danbury, Greylock FCU and Fiserv associates throughout the program to ensure their proposal is both viable and compelling. After completing their research, idea development and return on investment (ROI) analysis, the students will present their findings to Fiserv associates at the end of the semester. The program may be extended into the Fall semester with a new group of students to execute the business plan using DNAcreator to build the proposed DNAapp.

“The DNA platform from Fiserv fits nicely with UConn’s goal of fostering an entrepreneurial ecosystem within our state,” said Jeffrey Scarella, Industry Liaison, Physical Sciences & Engineering at the UConn Office of Economic Development. “By leveraging the intellectual power of our students and faculty, we hope to help community institutions like the Savings Bank of Danbury and Greylock Federal Credit Union, as well as leading financial innovators like Fiserv, provide the best possible banking experience to the next generation of Connecticut consumers.”

“This collaboration allows our students to use the knowledge, research skills, innovative thinking, and work ethic they’re acquiring at UConn in a very welcoming business environment provided by Fiserv,” said UConn Professor Michel Rakotomavo, faculty advisor for the project. “They have invaluable access to and interactions with executives from the partnering organizations and benefit from those organizations’ resources and information, making the experience truly distinctive in higher education.”

Additional Resources:

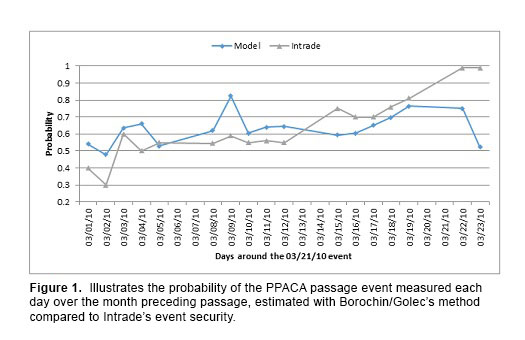

Storrs, Conn. (5/20/2014) – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor

Storrs, Conn. (5/20/2014) – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor