Darien News– For years, the local business community’s national reputation has been defined by its large corporations. But many of the region’s smaller firms are steadily raising their own profiles.

Faculty

Purdue Pharma grapples with growing protests

Special Class – Prof. Chinmoy Ghosh of University of Connecticut

Karnavati University– Dr. Chinmoy Ghosh, Gladstein Professor of Business and Innovation and Head of the Department of Finance at the School of Business, University of Connecticut, USA, took a long session with the Summer-9 students (2017-2019 batch) of UWSB, Kolkata on Friday, 17th August 2018.

Value of consultants’ manager recommendations questioned in new report

UConn Presents First-Ever Blockchain Symposium

More than two dozen researchers from around the world gathered at UConn’s Stamford campus last week to discuss one of the hottest topics in business:

How will the powerful and quickly-emerging Blockchain technology revolutionize businesses, both within organizations and between them? Continue Reading

The World Competes with Innovative Ecosystem…Merger & Acquisition of Large Enterprises

Maekyoung Economy Daily Newspaper– While the world is in the process of innovation competition, it is said that South Korea is glad that it has participated in this competition. It is at the Academy of Mangement (AOM), which is being held in Chicago, USA, from the 10th.

(Use Google Chrome for option to translate article)

Congressional Committee Investigates Purdue Pharma

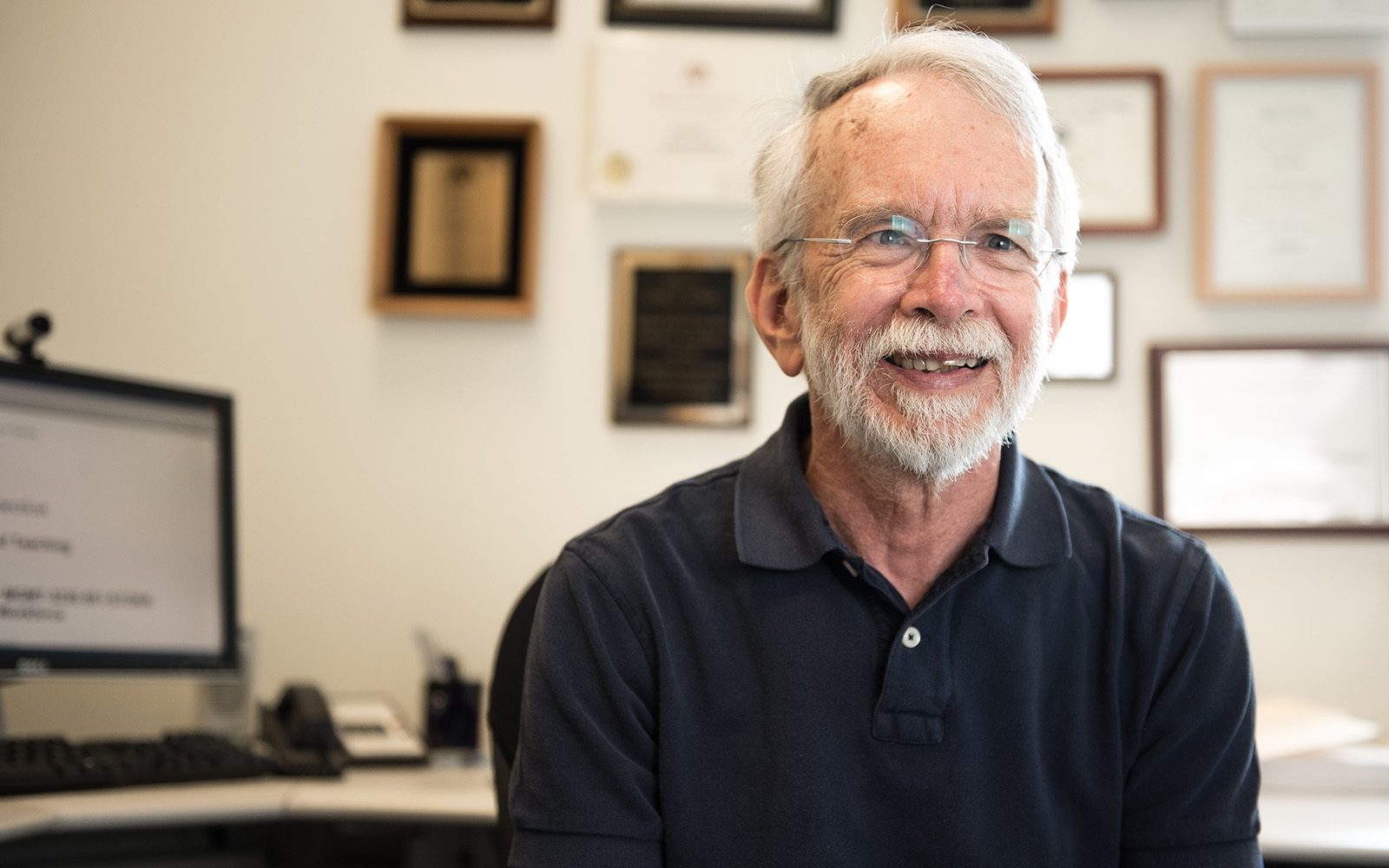

Professor Emeritus Gary Powell Earns International Recognition

Professor Emeritus Gary Powell will be recognized by the Family Firm Institute as the recipient of a 2018 Academic and Family Business Review Award at a global conference in London in October. Continue Reading