Finance

High-Income CT Sends U.S. More in Taxes Than It Gets Back

UConn Real Estate Students Finish Third in Prestigious International Competition

(11/12/2014) – A team of real estate students from the University of Connecticut School of Business earned third place in a prestigious international case competition on November 4 in New York City, sponsored by Cornell University.

The UConn team consisted of William Bartol, Drew Harney, Austin Smyth, Kristine Victor and Patrick Nista. Francesca Michel was the alternate.Continue Reading

Op-Ed | Is Connecticut Enjoying a Sustained Recovery?

Connecticut Sees Largest Job Gain in Two Decades

Carstensen Releases Final Report on Downtown North

Hartford Courant– UConn Economist Fred Carstensen, who was hired by the Hartford City Council to do analysis on the proposed downtown north development, has submitted his final report to the council.

12th Annual Real Estate Center Awards Banquet

(5/8/2014) – The 12th Annual Real Estate Awards Banquet was held at the South Campus Ballroom on Thursday, May 1. The special occasion recognized outstanding students, alumni, and scholarship recipients.

The following alumni and students were recognized for their achievements:

Lifetime Achievement Award: Daniel Ferraina, Ferraina Companies

Distinguished Alumni: Michael Riccio, CB-Richard Ellis Capital Markets

Alumni of the Year: Bradford Wainman, Simon Konover Development Corp.

Early Career Alumni: Kelsey Rath, Talcott Realty Investors, LLC

Organizational Partner: Greater New Haven Association of Realtors

Excellence in Research: Professor Carmelo Giaccotto and Professor Thomas Miceli

Students of the Year: Frances (Frankie) Gibbons and Andrew Kelly

Other student award recipients included: Nicolas Chapman, Tyler Cormier, Julia Dumaine, Andrew Harney, Scott Howard, M. Connor Lyman, Matthew McCandless, Cole McQuilken, Johncarlo Morales, Benjamin Napoli, Bridget O’Malley, Laura O’Malley, Ryan Powers, Peter Rodriguez, Colby Schaefer, Austin Smyth, Melissa Touger, Kristine Victor, and Hui Zhang.

Strong Corporate Support for Students in UConn Stamford’s New Financial Management Major

(6/30/2014) – The UConn School of Business is proud to announce a premier group of financial institutions supporting the School’s new undergraduate Financial Management major in Stamford.

The Financial Management major was designed and developed, in part, by CFA charterholders from prominent local hedge funds and investment firms. The major has been accepted into the CFA Institute’s University Recognition Program and stands to serve as inspiration to a program intent on helping cultivate a young generation of future CFA charterholders. The CFA credential has become one of the most globally respected designations and the Financial Management major, along with those selected within this program to join the Investment Management Program (IMP), will be exposed to academic and practical applications in finance coupled with reinforcement of strong ethical behavior.

“Through a progressive relationship with the CFA Society of Stamford, students who excel in the Financial Management major will be invited to join an exclusive Investment Management Program (IMP), which, among other benefits, provides access to a wide array of tools and research from financial institutions like Barclays, CreditSights, and Atlantic Asset Management,” said Jud Saviskas, executive director for the UConn School of Business in Stamford. “This innovative relationship encourages and facilitates an exchange of ideas, networking opportunities and career development for aspiring investment professionals – and it’s already received outside interest from many other colleges and universities.”

Last year, a group of IMP students travelled to Wall Street for a visit to several institutions such as Barclays, Bloomberg, and CreditSights. As program supporters, these companies allow students and faculty complimentary access to their client web portals such as, Barclays Live, which provides a range of research and financial analytics tools, and CreditSights’ online global research platform and an analytical staff of almost 80 investment professionals.

“Barclay’s and CreditSights’ web portals are an excellent tool for IMP students as they undertake the challenges of the program and the pursuit of the CFA Level I exam,” said Michael Dineen, senior vice president of Atlantic Asset Management and UConn adjunct professor.

Thomas Walsh, managing director at Barclays added that the collaboration with IMP is just one example of the importance the bank places on developing an early foundation of ethical investment knowledge. “The most successful students will be those who develop the skill sets they need to be productive and innovative members of the next generation’s workforce,” Walsh said. “We are delighted to be able to make Barclays Live available to IMP students and hope that they will derive significant benefit from these new resources.”

“We have had the pleasure to meet a number of IMP students, and they are coming into the space during interesting times in the evolution of the credit markets,” said Glenn Reynolds, CEO of CreditSights. “We hope the background information from prior credit cycles and our analysis of the structural shifts taking place today – most notably in banking and finance – can be of value as they prepare themselves for the role they can play in the markets. Credit has grown dramatically in all areas of the global economy from sovereign to corporate to household, and there are a lot of moving parts to the puzzle.”

Fiserv Collaborates with UConn School of Business on Next-Generation Banking Apps

Brookfield, Wis. and Hartford, Conn. (5/27/2014) – Fiserv, Inc. (NASDAQ: FISV), a leading global provider of financial services technology solutions, and the University of Connecticut School of Business, one of the top public business schools in the nation, today announced that Fiserv is participating in the university’s Financial Accelerator Program to help educate students and foster innovation.

Brookfield, Wis. and Hartford, Conn. (5/27/2014) – Fiserv, Inc. (NASDAQ: FISV), a leading global provider of financial services technology solutions, and the University of Connecticut School of Business, one of the top public business schools in the nation, today announced that Fiserv is participating in the university’s Financial Accelerator Program to help educate students and foster innovation.

The Financial Accelerator Program was established in 2002 to create opportunities for UConn students and faculty to apply classroom concepts to real business challenges. With the Fiserv initiative, UConn MBA students are collaborating with area business leaders from Fiserv and two of its clients, the Savings Bank of Danbury and Greylock Federal Credit Union, to explore how financial institutions can attract and serve Gen Y consumers using state-of-the-art banking technology.

“The Financial Accelerator Program at the University of Connecticut School of Business shines a spotlight on the exciting and innovative career opportunities available to students in the state,” said Connecticut Governor, Dannel P. Malloy. “Collaborations like this, which bring the leaders of tomorrow together with the leaders of today, foster the innovation and opportunity that help make Connecticut such an attractive place to live and work.”

The initiative, currently underway for the Spring 2014 semester, introduces UConn MBA students to the DNATM account account processing platform from Fiserv. DNA is a modern, enterprise-wide software platform relied upon by Savings Bank of Danbury and Greylock FCU as well as hundreds of other banks and credit unions for transaction processing, data management and customer relationship management. DNA offers a unique development toolkit – DNAcreatorTM – that allows users to create seamlessly integrated applications called DNAappsTM that extend the platform in new and powerful ways. At the conclusion of the Financial Accelerator Program, UConn students will present a business case for a new DNAapp that DNA users like Savings Bank of Danbury and Greylock FCU can use to enhance the millennial banking experience.

“DNA from Fiserv incorporates the latest industry standard tools and languages currently being taught at UConn and other leading universities where banks and credit unions can find a deep and talented pool of software engineers,” said Steve Cameron, president, Open Solutions Division, Fiserv. “By partnering with some of our region’s brightest minds at UConn, the Savings Bank of Danbury and Greylock Federal Credit Union, Fiserv is investing in the local community and continuing to build on our vision to drive the global digital transformation of financial services.”

The students will work with Savings Bank of Danbury, Greylock FCU and Fiserv associates throughout the program to ensure their proposal is both viable and compelling. After completing their research, idea development and return on investment (ROI) analysis, the students will present their findings to Fiserv associates at the end of the semester. The program may be extended into the Fall semester with a new group of students to execute the business plan using DNAcreator to build the proposed DNAapp.

“The DNA platform from Fiserv fits nicely with UConn’s goal of fostering an entrepreneurial ecosystem within our state,” said Jeffrey Scarella, Industry Liaison, Physical Sciences & Engineering at the UConn Office of Economic Development. “By leveraging the intellectual power of our students and faculty, we hope to help community institutions like the Savings Bank of Danbury and Greylock Federal Credit Union, as well as leading financial innovators like Fiserv, provide the best possible banking experience to the next generation of Connecticut consumers.”

“This collaboration allows our students to use the knowledge, research skills, innovative thinking, and work ethic they’re acquiring at UConn in a very welcoming business environment provided by Fiserv,” said UConn Professor Michel Rakotomavo, faculty advisor for the project. “They have invaluable access to and interactions with executives from the partnering organizations and benefit from those organizations’ resources and information, making the experience truly distinctive in higher education.”

Additional Resources:

UConn Finance Professors Propose New Method to Estimate the Full Value-Effect of an Event

Storrs, Conn. (5/20/2014) – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Storrs, Conn. (5/20/2014) – Paul Borochin, assistant professor of finance at UConn School of Business, together with finance professor Joseph Golec, propose an event study method using stock and option prices to account for the degree of investor anticipation to more accurately measure the full value effect of an event.

Finance researchers and practitioners both use the event study method to measure whether the announcement of new information has a statistically significant effect on a firm’s stock market value. Paul Borochin and Joseph Golec, professors of finance at the University of Connecticut, recently proposed a method that uses stock and option prices to account for the degree of investor anticipation of an event to therefore more accurately measure the full value effect of that event.

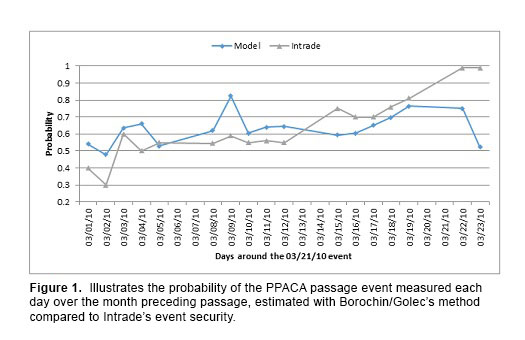

“The purpose of our study is to introduce a general method of estimating the degree of investor anticipation applicable to all significant events that affect firms with traded options,” says Borochin. “We apply this more general method to estimate probabilities to a complex event: U.S. House of Representatives passage of the healthcare reform law, the Patient Protection and Affordable Care Act of 2010 (PPACA). We also examine a related event with different potential for investor anticipation: the subsequent 2012 Supreme Court ruling on PPACA constitutionality, which was potentially a greater surprise due to the Court’s higher opacity.”

Borochin and Golec essentially interpret the financial market as a betting market. “…we get the same information from options prices that we could obtain from looking at the Intrade [or other betting market] website,” says Borochin.

“Indeed, one reason that we select PPACA passage to illustrate our method is that it also had event securities traded on Intrade, the leading prediction market at the time,” he says. “We compare the Intrade-generated probabilities for the 2010 and 2012 events to those we generate from options and stock prices as a robustness check. Our financial market-generated probabilities have two advantages over prediction market-generated probabilities: (1) they are derived from assets with much larger dollar volumes of trades,1 and (2), they can be estimated for any event that impacts companies with traded stock options.”

Borochin and Golec believe that their method could be useful for ex ante as well as ex post public policy analysis, citing legislation that often contains offsetting provisions negotiated among different political factions—in this case, the PPACA fee (tax) on brand name pharmaceutical sales.

They measure the effects ex post, but the method could be used for ex ante analysis by government or industry officials. “For example, Congress could publicly release a bill and a vote date. Based on the option market reaction to the vote announcement, both government and industry officials could determine investors’ estimates of the net effect of the bill’s provisions,” says Borochin.

“Our method could also be used to better estimate public or private damages associated with an event,” he adds. “The Securities and Exchange Commission often estimates damages from corporate fraud and the Federal Trade Commission estimates damages from illegal business practices. As long as some of the firms involved have traded stock and options, our method can give a more accurate estimate of total damages.”

Many event studies do not adjust for the fact that their events are partly anticipated, and in many cases, the degree of anticipation is difficult to measure. For the PPACA House vote event Borochin and Golec consider, the adjustment triples the measured effect of the event on the market value of the affected firms.

“We believe that [our method] is likely to be more precise than alternative methods such as using public data on firm-specific attributes to estimate event probabilities, or using event securities from relatively small prediction markets, because our method employs high-volume assets whose prices may partly reflect nonpublic information. For an event with substantial public information available (House passage), we find our probability estimate and that of a prediction market are quite close. But for an event with little public information (Supreme Court constitutionality), the estimates differ considerably,” said Borochin.

The working paper, “Using Options to Measure the Full Value-Effect of an Event: Application to the Healthcare Reform Act,” can be downloaded here.

1The daily value of PPACA contracts on Intrade averaged about $90,000 around the 2010 House vote event, while the average daily dollar value of stock ($277 million) and notional value of options ($397 million) traded for each company in our model totaled $674 million. The daily Intrade value was $35,000 during the 2012 Supreme Court event, while the average dollar stock and notional options trade value was $640 million.

Figure 1 –

The model-generated probability of PPACA passage compared to the Intrade-generated probability.

This figure plots the model-generated probability of PPACA passage by the U.S. House of Representatives, which is the probability implied by the stock and options prices of six hospital firms and six insurance firms. The Intrade-generated probability of PPACA passage is the price of an event security traded on the Intrade prediction market. Probabilities are shown for three weeks of trading before the event, the event day (March 22, 2010), and the day following the event.