The CT Mirror – It’s relatively easy to find consensus on where Connecticut must invest to improve its business climate. The bigger challenge for state government, said economists and business leaders Wednesday, will be to find the resources to invest — in transportation, information technology and higher education — as the cost of public-sector retirement benefits spikes over the next decade to 15 years.

Finance

Possible GE Departure Called a ‘Glaring Black Eye’ for State

Stock Prices Affected by NFL Game Outcomes

KCBS – Ever wonder what the payoff is—other than increased name recognition—for those companies that pay millions of dollars to put their name on a sports facility? New research has found that those companies and their investors can reap rewards or suffer losses depending upon the outcomes of the high interest games in those stadiums.

For a closer look, KCBS chats with Assaf Eisdorfer, associate professor of finance at the University of Connecticut School of Business:

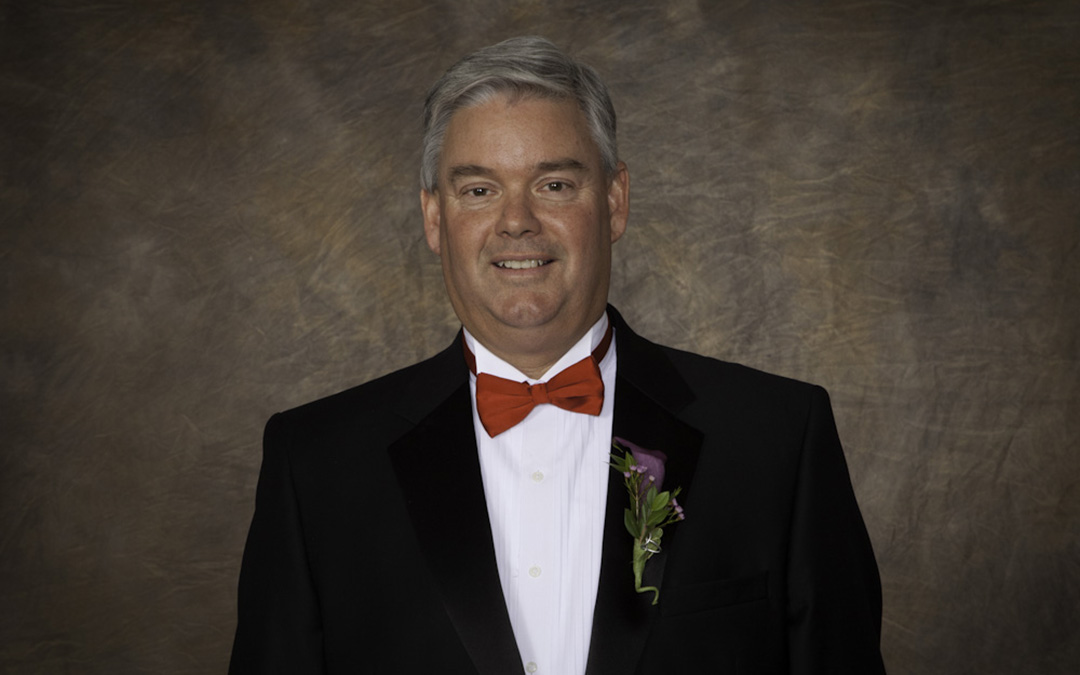

In Memoriam: Mark P. Coville ’79

Alumnus Mark P. Coville ’79, a 2013 inductee into the School of Business Hall of Fame who maintained a strong affinity for his alma mater, passed away on Dec. 10, 2015, after a two-year battle with leukemia. He was 58.

Coville was a managing director in BlackRock Inc.’s trading and liquidity strategy group and had a long and successful career in financial services. He graduated from UConn in 1979 with a degree in finance.Continue Reading

Careers in Finance: Perspectives from the Hartford CFA Society

On November 11th, 2015, the UConn School of Business Graduate Finance Association (GFA), in collaboration with the Office of Alumni Relations and CFA Society Hartford, hosted this year’s Careers in Finance CFA Panel and Networking Reception. Over 30 students from the Financial Risk Management (FRM), Full-time and Part-time MBA Programs were in attendance.Continue Reading

A Look Back at 2015: UConn Nation – Students

Year in Review

top1000funds.com – A research paper that concludes that the funds recommended to institutional investors by investment consultant do not add value, has won the Commonfund Prize, awarded for original research relevant to endowment and foundation asset management. The paper, by academics at Saïd Business School, Oxford University and University of Connecticut School of Business, found that…

Dan Toscano ’87

School of Business Alumnus Chairs UConn Foundation Board; ‘Let’s Be the Best… That’s What it Means to Come to UConn’

When alumnus Dan Toscano ’87 talks about the need for more scholarships to help UConn students, he speaks from the heart.

“I had some very discouraging moments when I was a student here and the tuition was due and I didn’t quite have it pulled together yet,” he recalled during a recent interview. “My wife, Tresa, and I had to fight to get through college financially. I remember those days vividly. I don’t want to see anyone else go through that.”Continue Reading

Reverse Stress Testing

Finance Professor Wins Best Paper Award for Creating Insightful, Novel Method of Risk Assessment

Finance professor Yaacov Kopeliovich and his RiXtrema research team colleagues have won the 2015 Peter L. Bernstein Award for Best Paper for their work titled, “Robust Risk Estimation and Hedging: A Reverse Stress Testing Approach.”

The article originally appeared in the Journal of Derivatives in May 2015. It was selected by a three-person review committee and was chosen from a pool of nominations from 11 top financial journals. The judges looked for an original or new approach to the field or subject of study; surprising and/or insightful results or implications; and both practical and academic relevance.Continue Reading